Summary

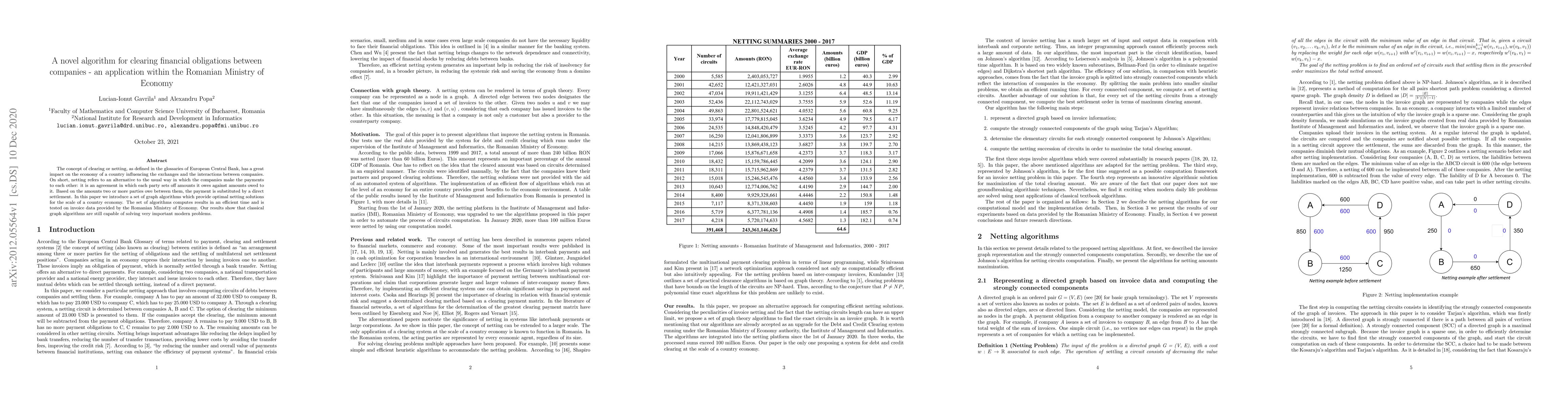

The concept of clearing or netting, as defined in the glossaries of European Central Bank, has a great impact on the economy of a country influencing the exchanges and the interactions between companies. On short, netting refers to an alternative to the usual way in which the companies make the payments to each other: it is an agreement in which each party sets off amounts it owes against amounts owed to it. Based on the amounts two or more parties owe between them, the payment is substituted by a direct settlement. In this paper we introduce a set of graph algorithms which provide optimal netting solutions for the scale of a country economy. The set of algorithms computes results in an efficient time and is tested on invoice data provided by the Romanian Ministry of Economy. Our results show that classical graph algorithms are still capable of solving very important modern problems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Clearing Payments in a Financial Contagion Model

Anton V. Proskurnikov, Giuseppe Calafiore, Giulia Fracastoro

Contingent Convertible Obligations and Financial Stability

Zachary Feinstein, T. R. Hurd

| Title | Authors | Year | Actions |

|---|

Comments (0)