Authors

Summary

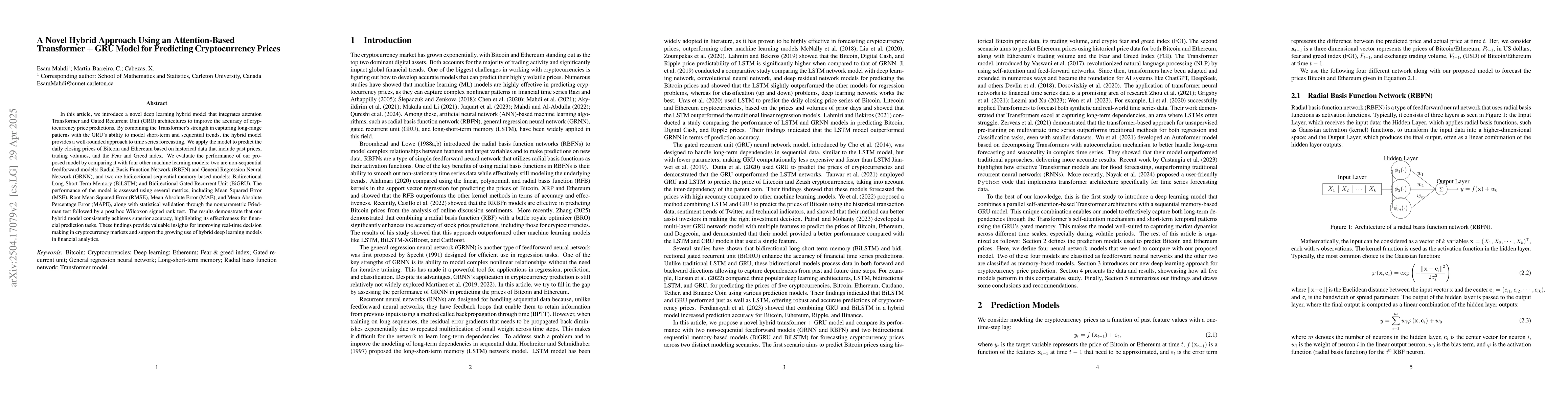

In this article, we introduce a novel deep learning hybrid model that integrates attention Transformer and Gated Recurrent Unit (GRU) architectures to improve the accuracy of cryptocurrency price predictions. By combining the Transformer's strength in capturing long-range patterns with the GRU's ability to model short-term and sequential trends, the hybrid model provides a well-rounded approach to time series forecasting. We apply the model to predict the daily closing prices of Bitcoin and Ethereum based on historical data that include past prices, trading volumes, and the Fear and Greed index. We evaluate the performance of our proposed model by comparing it with four other machine learning models: two are non-sequential feedforward models: Radial Basis Function Network (RBFN) and General Regression Neural Network (GRNN), and two are bidirectional sequential memory-based models: Bidirectional Long-Short-Term Memory (BiLSTM) and Bidirectional Gated Recurrent Unit (BiGRU). The performance of the model is assessed using several metrics, including Mean Squared Error (MSE), Root Mean Squared Error (RMSE), Mean Absolute Error (MAE), and Mean Absolute Percentage Error (MAPE), along with statistical validation through the nonparametric Friedman test followed by a post hoc Wilcoxon signed rank test. The results demonstrate that our hybrid model consistently achieves superior accuracy, highlighting its effectiveness for financial prediction tasks. These findings provide valuable insights for improving real-time decision making in cryptocurrency markets and support the growing use of hybrid deep learning models in financial analytics.

AI Key Findings

Generated Jun 09, 2025

Methodology

The research introduces a hybrid deep learning model combining an attention-based Transformer and Gated Recurrent Unit (GRU) architectures for predicting cryptocurrency prices. It uses historical data including past prices, trading volumes, and the Fear and Greed index for Bitcoin and Ethereum.

Key Results

- The hybrid model consistently outperforms other machine learning models (RBFN, GRNN, BiGRU, BiLSTM) in predicting cryptocurrency prices.

- The proposed model achieves significantly lower Mean Squared Error (MSE), Root Mean Squared Error (RMSE), Mean Absolute Error (MAE), and Mean Absolute Percentage Error (MAPE) compared to the competing models.

Significance

This research provides a robust model for real-time decision-making in cryptocurrency markets, offering valuable insights for traders and analysts seeking data-driven strategies based on historical patterns.

Technical Contribution

The paper demonstrates the effectiveness of a hybrid architecture combining long-range pattern recognition with short-term temporal modeling for time series forecasting.

Novelty

The novelty lies in integrating the Transformer's strength in capturing long-range dependencies with the GRU's ability to model short-term and sequential trends, providing a well-rounded approach to time series forecasting in financial analytics.

Limitations

- The study focuses only on Bitcoin and Ethereum, which may not represent the full spectrum of cryptocurrency behavior.

- The model uses a fixed one-time-step lag, potentially missing more complex temporal dependencies.

Future Work

- Expand the model to a wider range of univariate and multivariate digital assets and stock markets.

- Test different lag structures and explore alternative hybrid architectures such as Transformer+LSTM or Transformer+BiLSTM/BiGRU.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinBERT-BiLSTM: A Deep Learning Model for Predicting Volatile Cryptocurrency Market Prices Using Market Sentiment Dynamics

Md Mosaddek Khan, Md Mahmudur Rahman, Mabsur Fatin Bin Hossain et al.

Attention based Bidirectional GRU hybrid model for inappropriate content detection in Urdu language

Ezzah Shoukat, Rabia Irfan, Iqra Basharat et al.

No citations found for this paper.

Comments (0)