Summary

Application of fuzzy support vector machine in stock price forecast. Support vector machine is a new type of machine learning method proposed in 1990s. It can deal with classification and regression problems very successfully. Due to the excellent learning performance of support vector machine, the technology has become a hot research topic in the field of machine learning, and it has been successfully applied in many fields. However, as a new technology, there are many limitations to support vector machines. There is a large amount of fuzzy information in the objective world. If the training of support vector machine contains noise and fuzzy information, the performance of the support vector machine will become very weak and powerless. As the complexity of many factors influence the stock price prediction, the prediction results of traditional support vector machine cannot meet people with precision, this study improved the traditional support vector machine fuzzy prediction algorithm is proposed to improve the new model precision. NASDAQ Stock Market, Standard & Poor's (S&P) Stock market are considered. Novel advanced- fuzzy support vector machine (NA-FSVM) is the proposed methodology.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

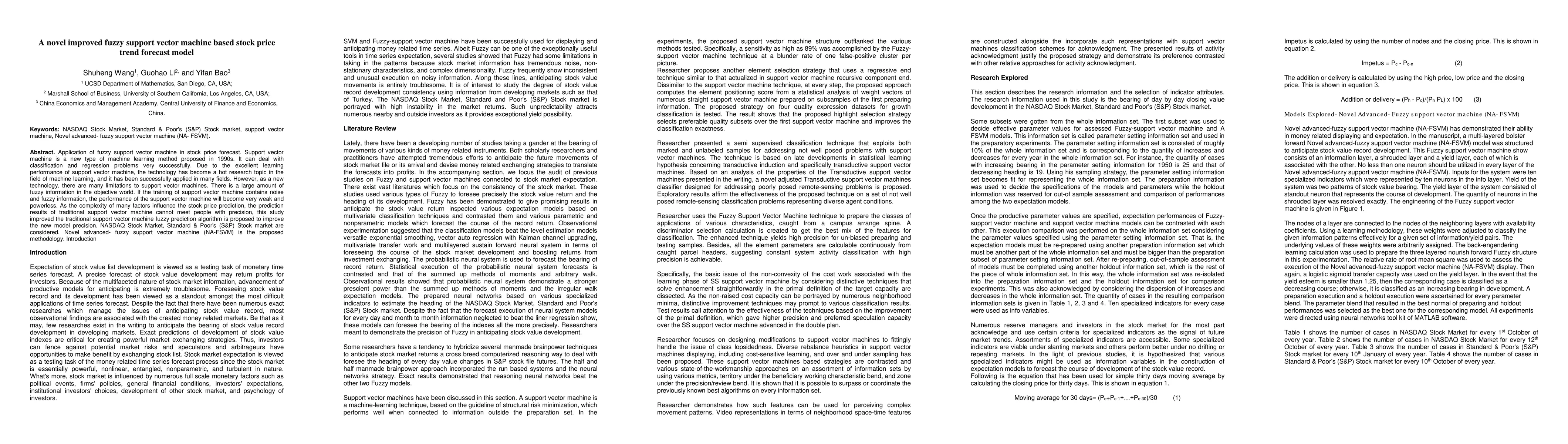

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)