Summary

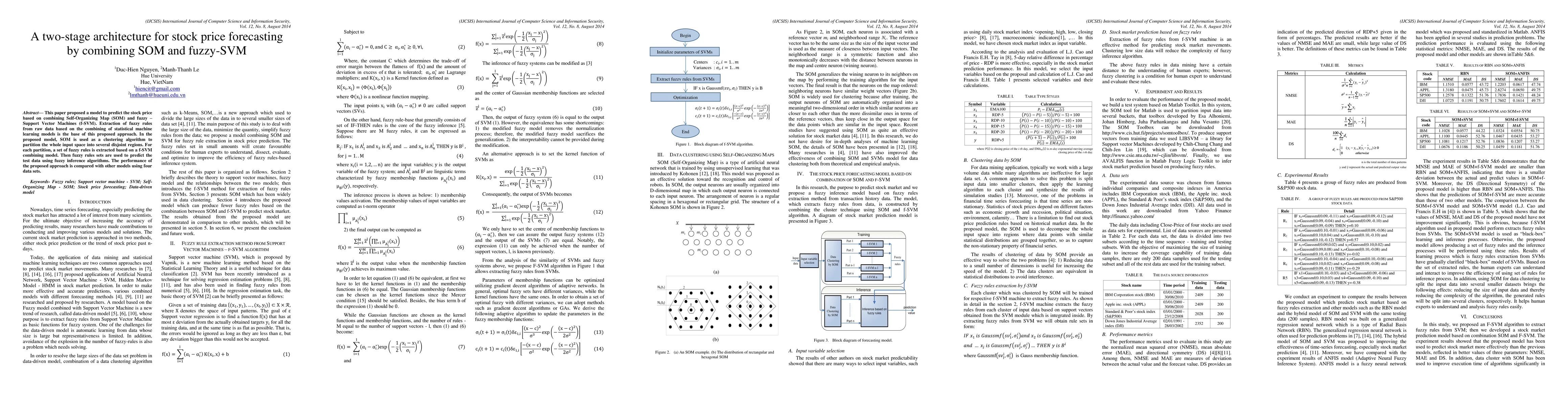

This paper proposed a model to predict the stock price based on combining Self-Organizing Map (SOM) and fuzzy-Support Vector Machines (f-SVM). Extraction of fuzzy rules from raw data based on the combining of statistical machine learning models is base of this proposed approach. In the proposed model, SOM is used as a clustering algorithm to partition the whole input space into the several disjoint regions. For each partition, a set of fuzzy rules is extracted based on a f-SVM combining model. Then fuzzy rules sets are used to predict the test data using fuzzy inference algorithms. The performance of the proposed approach is compared with other models using four data sets

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMASTER: Market-Guided Stock Transformer for Stock Price Forecasting

Yanyan Shen, Zhaoyang Liu, Tong Li et al.

A Neuro-Fuzzy System for Interpretable Long-Term Stock Market Forecasting

Vitomir Štruc, Igor Škrjanc, Miha Ožbot

ResNLS: An Improved Model for Stock Price Forecasting

Basem Suleiman, Ali Anaissi, Yuanzhe Jia

| Title | Authors | Year | Actions |

|---|

Comments (0)