Authors

Summary

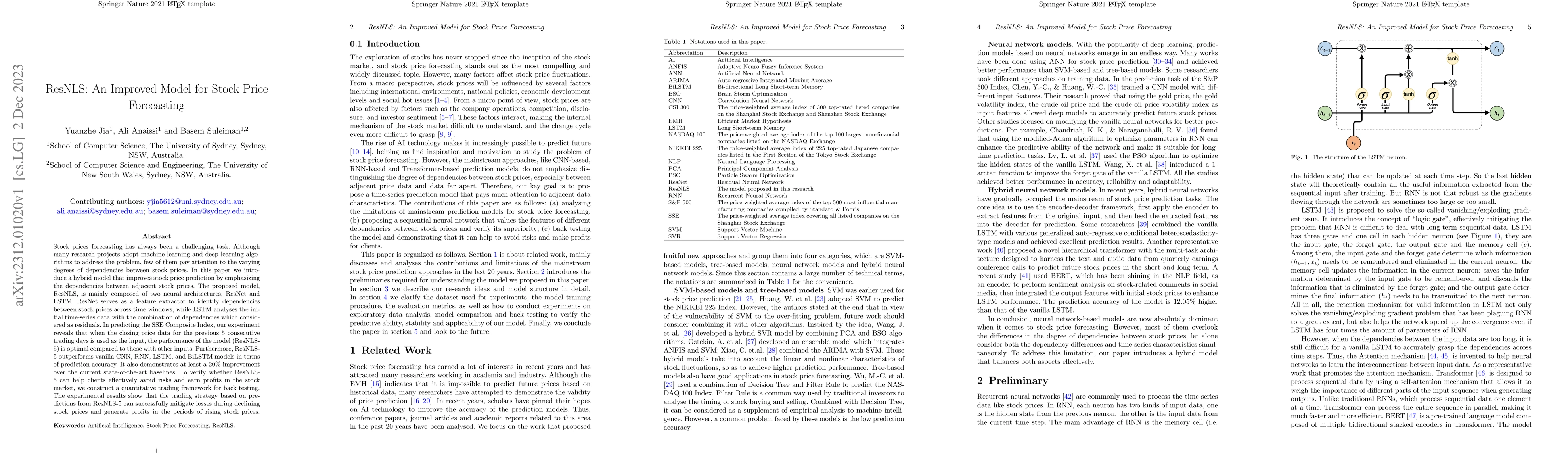

Stock prices forecasting has always been a challenging task. Although many research projects adopt machine learning and deep learning algorithms to address the problem, few of them pay attention to the varying degrees of dependencies between stock prices. In this paper we introduce a hybrid model that improves stock price prediction by emphasizing the dependencies between adjacent stock prices. The proposed model, ResNLS, is mainly composed of two neural architectures, ResNet and LSTM. ResNet serves as a feature extractor to identify dependencies between stock prices across time windows, while LSTM analyses the initial time-series data with the combination of dependencies which considered as residuals. In predicting the SSE Composite Index, our experiment reveals that when the closing price data for the previous 5 consecutive trading days is used as the input, the performance of the model (ResNLS-5) is optimal compared to those with other inputs. Furthermore, ResNLS-5 outperforms vanilla CNN, RNN, LSTM, and BiLSTM models in terms of prediction accuracy. It also demonstrates at least a 20% improvement over the current state-of-the-art baselines. To verify whether ResNLS-5 can help clients effectively avoid risks and earn profits in the stock market, we construct a quantitative trading framework for back testing. The experimental results show that the trading strategy based on predictions from ResNLS-5 can successfully mitigate losses during declining stock prices and generate profits in the periods of rising stock prices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMASTER: Market-Guided Stock Transformer for Stock Price Forecasting

Yanyan Shen, Zhaoyang Liu, Tong Li et al.

Hidformer: Transformer-Style Neural Network in Stock Price Forecasting

Kamil Ł. Szydłowski, Jarosław A. Chudziak

| Title | Authors | Year | Actions |

|---|

Comments (0)