Summary

We present a parsimonious neural network approach, which does not rely on dynamic programming techniques, to solve dynamic portfolio optimization problems subject to multiple investment constraints. The number of parameters of the (potentially deep) neural network remains independent of the number of portfolio rebalancing events, and in contrast to, for example, reinforcement learning, the approach avoids the computation of high-dimensional conditional expectations. As a result, the approach remains practical even when considering large numbers of underlying assets, long investment time horizons or very frequent rebalancing events. We prove convergence of the numerical solution to the theoretical optimal solution of a large class of problems under fairly general conditions, and present ground truth analyses for a number of popular formulations, including mean-variance and mean-conditional value-at-risk problems. We also show that it is feasible to solve Sortino ratio-inspired objectives (penalizing only the variance of wealth outcomes below the mean) in dynamic trading settings with the proposed approach. Using numerical experiments, we demonstrate that if the investment objective functional is separable in the sense of dynamic programming, the correct time-consistent optimal investment strategy is recovered, otherwise we obtain the correct pre-commitment (time-inconsistent) investment strategy. The proposed approach remains agnostic as to the underlying data generating assumptions, and results are illustrated using (i) parametric models for underlying asset returns, (ii) stationary block bootstrap resampling of empirical returns, and (iii) generative adversarial network (GAN)-generated synthetic asset returns.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

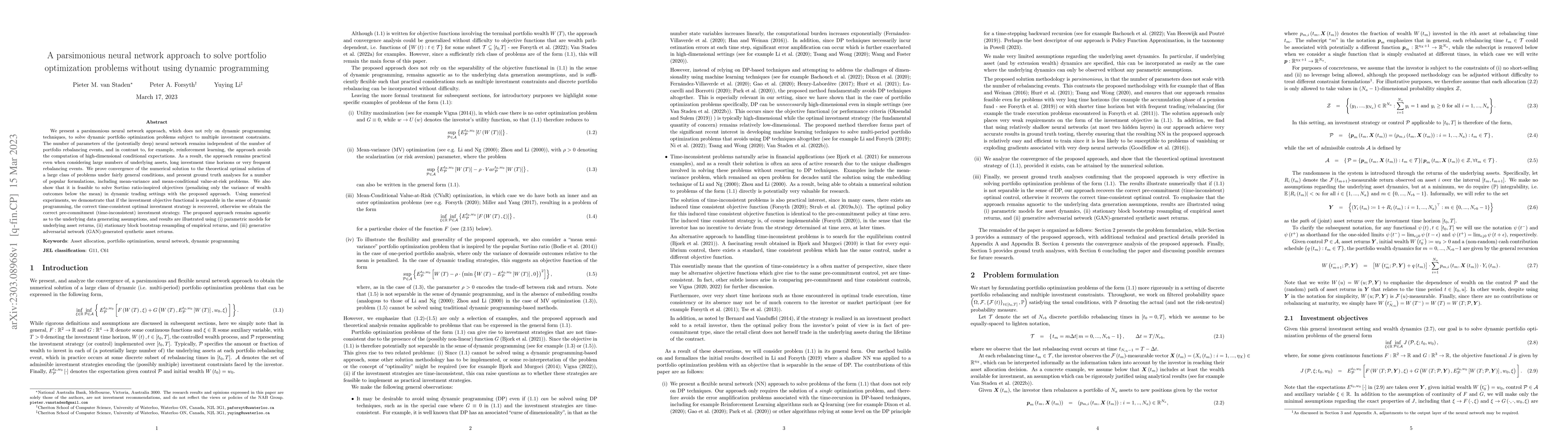

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)