Yuying Li

16 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

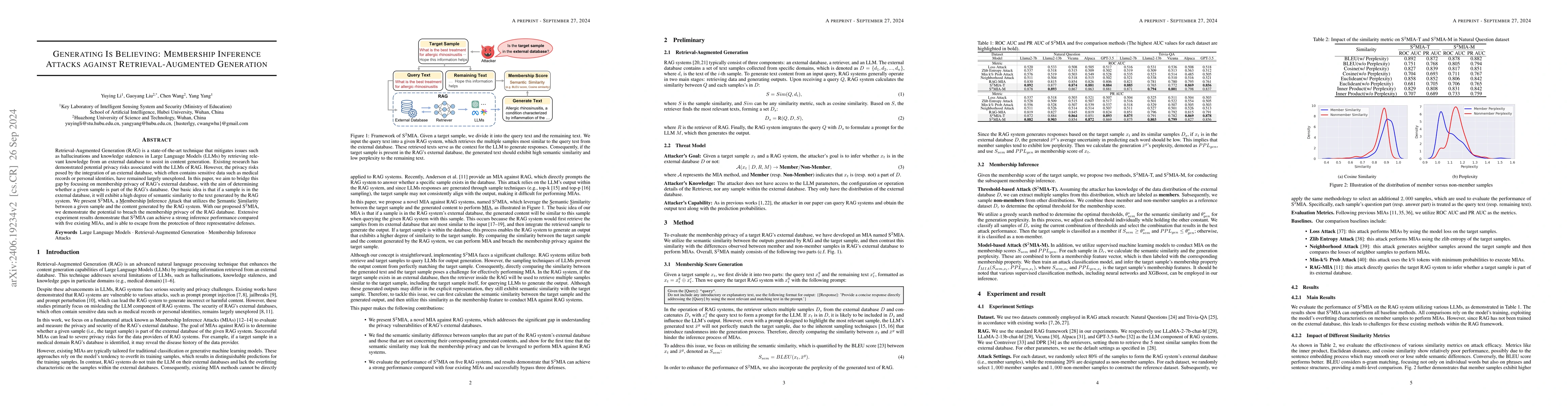

Seeing Is Believing: Black-Box Membership Inference Attacks Against Retrieval Augmented Generation

Retrieval-Augmented Generation (RAG) is a state-of-the-art technique that enhances Large Language Models (LLMs) by retrieving relevant knowledge from an external, non-parametric database. This approac...

An ethical study of generative AI from the Actor-Network Theory perspective

The widespread use of Generative Artificial Intelligence in the innovation and generation of communication content is mainly due to its exceptional creative ability, operational efficiency, and comp...

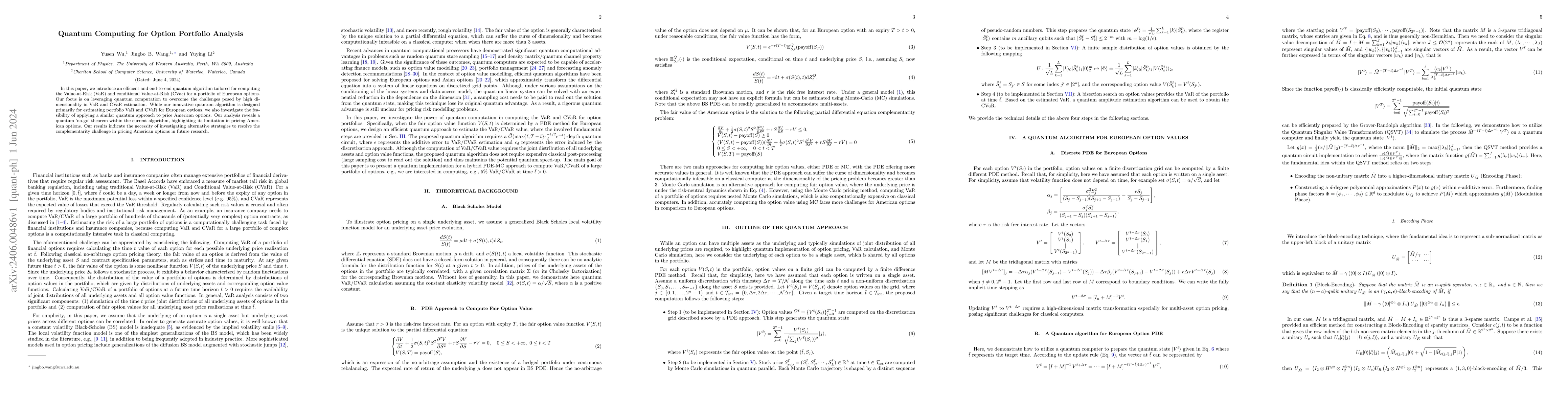

Quantum Computing for Option Portfolio Analysis

In this paper, we introduce an efficient and end-to-end quantum algorithm tailored for computing the Value-at-Risk (VaR) and conditional Value-at-Risk (CVar) for a portfolio of European options. Our...

The Adversarial AI-Art: Understanding, Generation, Detection, and Benchmarking

Generative AI models can produce high-quality images based on text prompts. The generated images often appear indistinguishable from images generated by conventional optical photography devices or c...

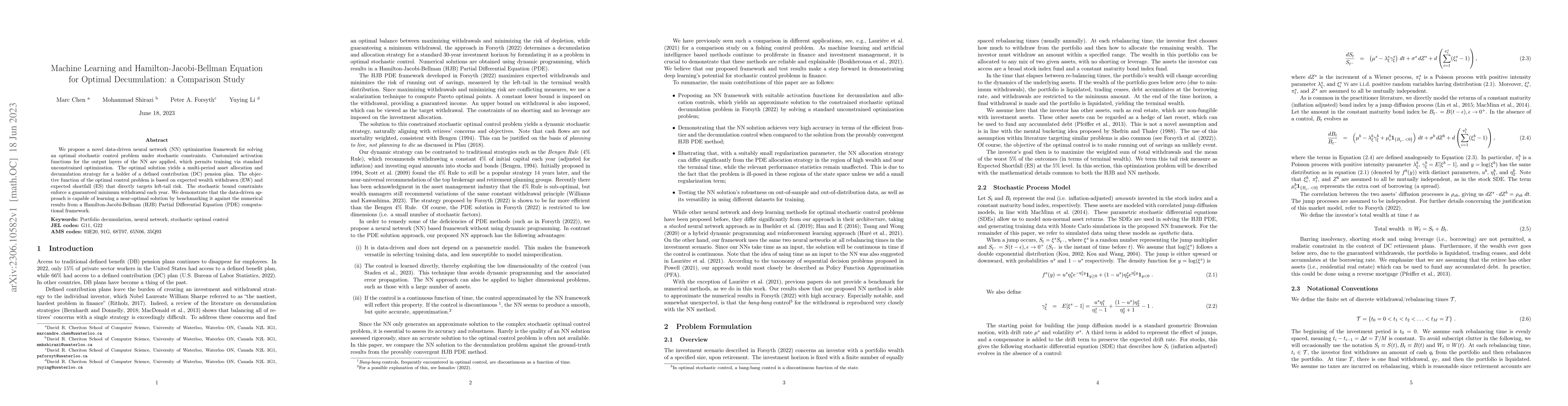

Machine Learning and Hamilton-Jacobi-Bellman Equation for Optimal Decumulation: a Comparison Study

We propose a novel data-driven neural network (NN) optimization framework for solving an optimal stochastic control problem under stochastic constraints. Customized activation functions for the outp...

Neural Network Approach to Portfolio Optimization with Leverage Constraints:a Case Study on High Inflation Investment

Motivated by the current global high inflation scenario, we aim to discover a dynamic multi-period allocation strategy to optimally outperform a passive benchmark while adhering to a bounded leverag...

A parsimonious neural network approach to solve portfolio optimization problems without using dynamic programming

We present a parsimonious neural network approach, which does not rely on dynamic programming techniques, to solve dynamic portfolio optimization problems subject to multiple investment constraints....

A Composite T60 Regression and Classification Approach for Speech Dereverberation

Dereverberation is often performed directly on the reverberant audio signal, without knowledge of the acoustic environment. Reverberation time, T60, however, is an essential acoustic factor that ref...

Smart leverage? Rethinking the role of Leveraged Exchange Traded Funds in constructing portfolios to beat a benchmark

Leveraged Exchange Traded Funds (LETFs), while extremely controversial in the literature, remain stubbornly popular with both institutional and retail investors in practice. While the criticisms of LE...

Uniquely $C_{4}^{+}$-saturated graphs

A graph $G$ is uniquely $H$-saturated if it contains no copy of a graph $H$ as a subgraph, but adding any new edge into $G$ creates exactly one copy of $H$. Let $C_{4}^{+}$ be the diamond graph consis...

Risk Measures for DC Pension Plan Decumulation

As the developed world replaces Defined Benefit (DB) pension plans with Defined Contribution (DC) plans, there is a need to develop decumulation strategies for DC plan holders. Optimal decumulation ca...

MathClean: A Benchmark for Synthetic Mathematical Data Cleaning

With the rapid development of large language models (LLMs), the quality of training data has become crucial. Among the various types of training data, mathematical data plays a key role in enabling LL...

Monte-Carlo Option Pricing in Quantum Parallel

Financial derivative pricing is a significant challenge in finance, involving the valuation of instruments like options based on underlying assets. While some cases have simple solutions, many require...

Making Leveraged Exchange-Traded Funds Work for your Portfolio

We examine strategically incorporating broad stock market leveraged exchange-traded funds (LETFs) into investment portfolios. We demonstrate that easily understandable and implementable strategies can...

CapGeo: A Caption-Assisted Approach to Geometric Reasoning

Geometric reasoning remains a core challenge for Multimodal Large Language Models (MLLMs). Even the most advanced closed-source systems, such as GPT-O3 and Gemini-2.5-Pro, still struggle to solve geom...

Rethinking Text-to-SQL: Dynamic Multi-turn SQL Interaction for Real-world Database Exploration

Recent advances in Text-to-SQL have achieved strong results in static, single-turn tasks, where models generate SQL queries from natural language questions. However, these systems fall short in real-w...