Authors

Summary

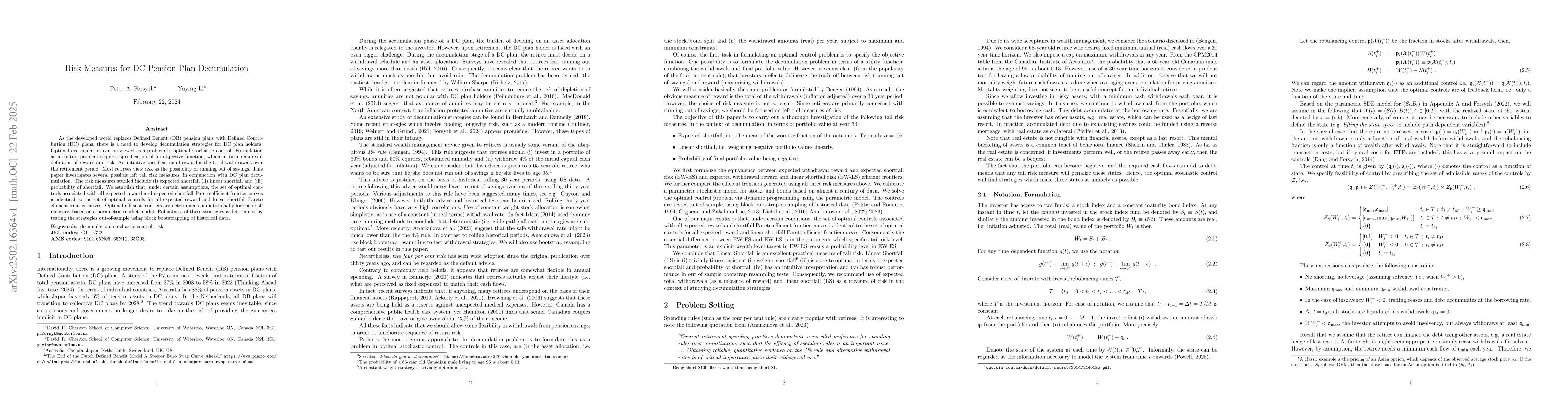

As the developed world replaces Defined Benefit (DB) pension plans with Defined Contribution (DC) plans, there is a need to develop decumulation strategies for DC plan holders. Optimal decumulation can be viewed as a problem in optimal stochastic control. Formulation as a control problem requires specification of an objective function, which in turn requires a definition of reward and risk. An intuitive specification of reward is the total withdrawals over the retirement period. Most retirees view risk as the possibility of running out of savings. This paper investigates several possible left tail risk measures, in conjunction with DC plan decumulation. The risk measures studied include (i) expected shortfall (ii) linear shortfall and (iii) probability of shortfall. We establish that, under certain assumptions, the set of optimal controls associated with all expected reward and expected shortfall Pareto efficient frontier curves is identical to the set of optimal controls for all expected reward and linear shortfall Pareto efficient frontier curves. Optimal efficient frontiers are determined computationally for each risk measure, based on a parametric market model. Robustness of these strategies is determined by testing the strategies out-of-sample using block bootstrapping of historical data.

AI Key Findings

Generated Jun 11, 2025

Methodology

This research determines spending rules for decumulation of DC pension plans as solutions to an optimal stochastic control problem, solved numerically using a parametric model of long-term stock and bond returns.

Key Results

- The set of optimal controls associated with all expected reward and expected shortfall Pareto efficient frontier curves is identical to the set of optimal controls for all expected reward and linear shortfall Pareto efficient frontier curves.

- Optimal efficient frontiers are determined computationally for each risk measure, based on a parametric market model.

- Robustness of these strategies is tested out-of-sample using block bootstrapping of historical data.

- The EW-LS control is more robust compared to EW-ES when tested in the historical (bootstrapped) market.

- The EW-LS control, withdrawing 5% of initial wealth annually on average, has a 98% probability of success with an ES(5%) ≃ -$15,000 under bootstrap resampling tests.

Significance

This study provides a mathematical framework for determining optimal decumulation strategies for DC pension plans, emphasizing the appropriateness of linear shortfall (LS) as a risk measure, which is interpretable and robust.

Technical Contribution

The paper establishes a mathematical equivalence between optimal controls under expected reward and expected shortfall versus expected reward and linear shortfall, ensuring time consistency for the former under the latter risk measure.

Novelty

This research distinguishes itself by formulating decumulation strategies as solutions to an optimal stochastic control problem, contrasting with previous work that primarily tested heuristic spending rules using historical data.

Limitations

- The study relies on a parametric market model, which may not fully capture the complexities of real-world market dynamics.

- The results are based on historical data and assumptions, which may not accurately predict future market conditions.

Future Work

- Further investigation into the application of machine learning techniques for computing optimal controls directly from bootstrapped resampled data.

- Exploration of more complex investment choices beyond stock and bond index funds.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Management of DC Pension Plan with Inflation Risk and Tail VaR Constraint

Zuo Quan Xu, Hui Mi, Dongfang Yang

Machine Learning and Hamilton-Jacobi-Bellman Equation for Optimal Decumulation: a Comparison Study

Yuying Li, Mohammad Shirazi, Marc Chen et al.

No citations found for this paper.

Comments (0)