Authors

Summary

This paper investigates an optimal investment problem under the tail Value at Risk (tail VaR, also known as expected shortfall, conditional VaR, average VaR) and portfolio insurance constraints confronted by a defined-contribution pension member. The member's aim is to maximize the expected utility from the terminal wealth exceeding the minimum guarantee by investing his wealth in a cash bond, an inflation-linked bond and a stock. Due to the presence of the tail VaR constraint, the problem cannot be tackled by standard control tools. We apply the Lagrange method along with quantile optimization techniques to solve the problem. Through delicate analysis, the optimal investment output in closed-form and optimal investment strategy are derived. A numerical analysis is also provided to show how the constraints impact the optimal investment output and strategy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

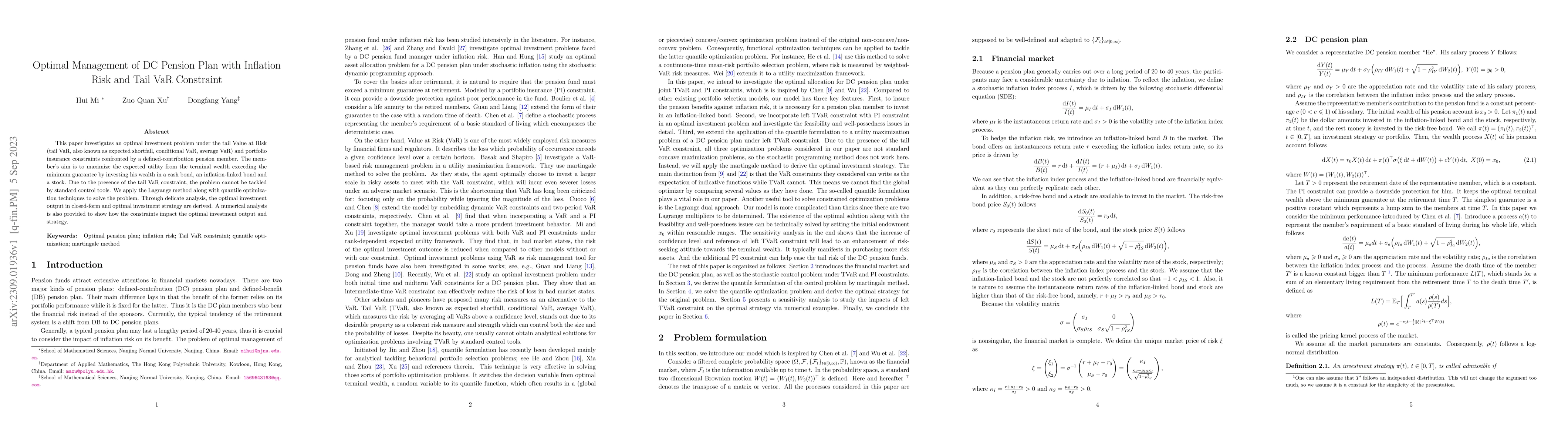

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)