Summary

We propose a novel data-driven neural network (NN) optimization framework for solving an optimal stochastic control problem under stochastic constraints. Customized activation functions for the output layers of the NN are applied, which permits training via standard unconstrained optimization. The optimal solution yields a multi-period asset allocation and decumulation strategy for a holder of a defined contribution (DC) pension plan. The objective function of the optimal control problem is based on expected wealth withdrawn (EW) and expected shortfall (ES) that directly targets left-tail risk. The stochastic bound constraints enforce a guaranteed minimum withdrawal each year. We demonstrate that the data-driven approach is capable of learning a near-optimal solution by benchmarking it against the numerical results from a Hamilton-Jacobi-Bellman (HJB) Partial Differential Equation (PDE) computational framework.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

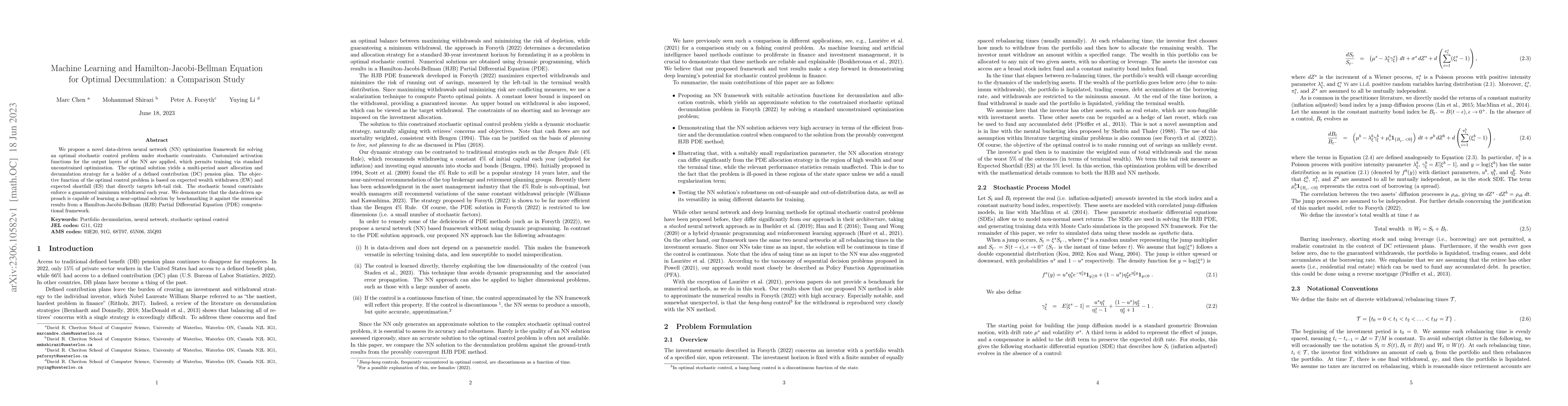

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHamilton-Jacobi-Bellman Equation Arising from Optimal Portfolio Selection Problem

Daniel Sevcovic, Cyril Izuchukwu Udeani

Stochastic optimal transport and Hamilton-Jacobi-Bellman equations on the set of probability measures

Charles Bertucci

| Title | Authors | Year | Actions |

|---|

Comments (0)