Authors

Summary

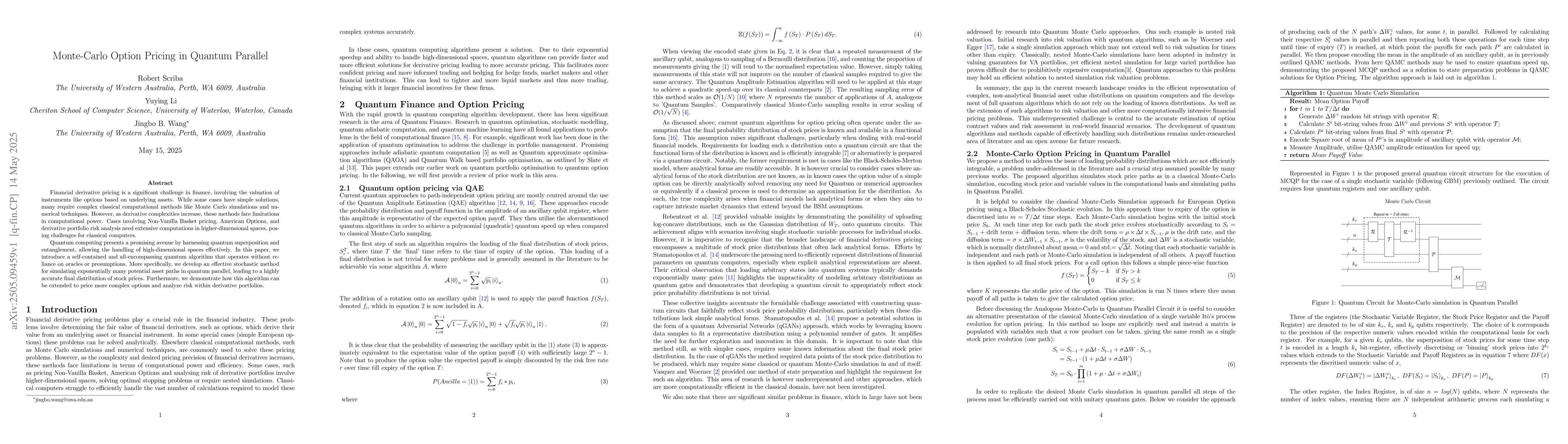

Financial derivative pricing is a significant challenge in finance, involving the valuation of instruments like options based on underlying assets. While some cases have simple solutions, many require complex classical computational methods like Monte Carlo simulations and numerical techniques. However, as derivative complexities increase, these methods face limitations in computational power. Cases involving Non-Vanilla Basket pricing, American Options, and derivative portfolio risk analysis need extensive computations in higher-dimensional spaces, posing challenges for classical computers. Quantum computing presents a promising avenue by harnessing quantum superposition and entanglement, allowing the handling of high-dimensional spaces effectively. In this paper, we introduce a self-contained and all-encompassing quantum algorithm that operates without reliance on oracles or presumptions. More specifically, we develop an effective stochastic method for simulating exponentially many potential asset paths in quantum parallel, leading to a highly accurate final distribution of stock prices. Furthermore, we demonstrate how this algorithm can be extended to price more complex options and analyze risk within derivative portfolios.

AI Key Findings

Generated Jun 08, 2025

Methodology

The paper introduces a quantum algorithm for Monte Carlo option pricing, utilizing quantum superposition and entanglement to simulate exponentially many potential asset paths in parallel, leading to an accurate final distribution of stock prices.

Key Results

- Development of a self-contained quantum algorithm for option pricing without relying on oracles or presumptions.

- Demonstration of the algorithm's effectiveness in pricing complex options and analyzing risk within derivative portfolios.

Significance

This research is important as it presents a quantum computing approach to overcome classical computational limitations in pricing complex financial derivatives, potentially revolutionizing financial modeling and risk analysis.

Technical Contribution

The introduction of a novel quantum stochastic method for simulating high-dimensional asset path spaces in parallel, enabling efficient Monte Carlo option pricing.

Novelty

This work stands out by proposing a quantum algorithm that doesn't depend on oracles or presumptions, offering a comprehensive solution for pricing complex derivatives and analyzing portfolio risks.

Limitations

- The paper does not discuss the current state of quantum hardware capabilities and their impact on the proposed algorithm's practical implementation.

- Potential scalability issues with increasing the dimensionality of the problem are not addressed.

Future Work

- Investigate the algorithm's performance on near-term quantum devices.

- Explore methods to mitigate errors and enhance the algorithm's scalability for larger, more complex problems.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDenoised Monte Carlo for option pricing and Greeks estimation

Andrzej Daniluk, Evgeny Lakshtanov, Rafal Muchorski

No citations found for this paper.

Comments (0)