Authors

Summary

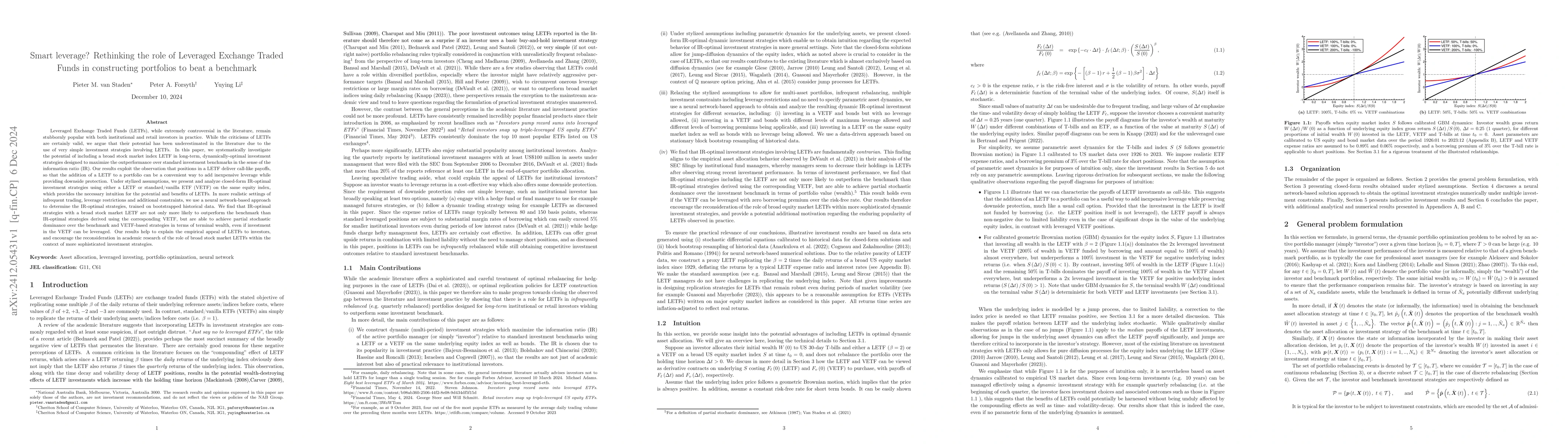

Leveraged Exchange Traded Funds (LETFs), while extremely controversial in the literature, remain stubbornly popular with both institutional and retail investors in practice. While the criticisms of LETFs are certainly valid, we argue that their potential has been underestimated in the literature due to the use of very simple investment strategies involving LETFs. In this paper, we systematically investigate the potential of including a broad stock market index LETF in long-term, dynamically-optimal investment strategies designed to maximize the outperformance over standard investment benchmarks in the sense of the information ratio (IR). Our results exploit the observation that positions in a LETF deliver call-like payoffs, so that the addition of a LETF to a portfolio can be a convenient way to add inexpensive leverage while providing downside protection. Under stylized assumptions, we present and analyze closed-form IR-optimal investment strategies using either a LETF or standard/vanilla ETF (VETF) on the same equity index, which provides the necessary intuition for the potential and benefits of LETFs. In more realistic settings, we use a neural network-based approach to determine the IR-optimal strategies, trained on bootstrapped historical data. We find that IR-optimal strategies with a broad stock market LETF are not only more likely to outperform the benchmark than IR-optimal strategies derived using the corresponding VETF, but are able to achieve partial stochastic dominance over the benchmark and VETF-based strategies in terms of terminal wealth.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMaking Leveraged Exchange-Traded Funds Work for your Portfolio

Yuying Li, Pieter van Staden, Peter Forsyth

The information flow among Green Bonds exchange traded funds

Tiago A. E. Ferreira, Wenderson Gomes Barbosa, Kerolly Kedma Felix do Nascimento et al.

No citations found for this paper.

Comments (0)