Summary

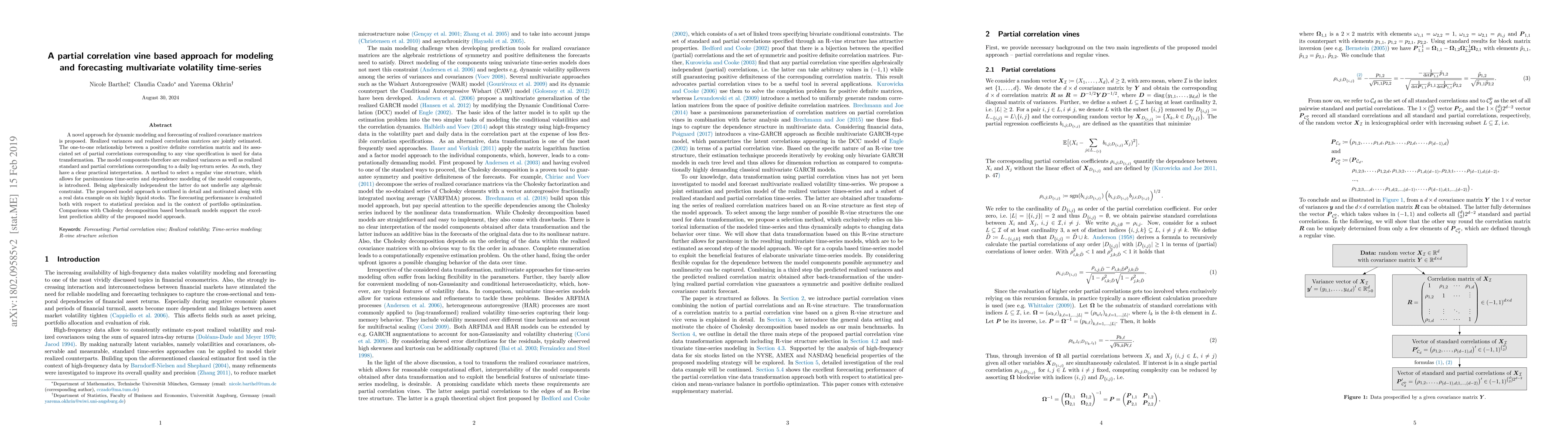

A novel approach for dynamic modeling and forecasting of realized covariance matrices is proposed. Realized variances and realized correlation matrices are jointly estimated. The one-to-one relationship between a positive definite correlation matrix and its associated set of partial correlations corresponding to any vine specification is used for data transformation. The model components therefore are realized variances as well as realized standard and partial correlations corresponding to a daily log-return series. As such, they have a clear practical interpretation. A method to select a regular vine structure, which allows for parsimonious time-series and dependence modeling of the model components, is introduced. Being algebraically independent the latter do not underlie any algebraic constraint. The proposed model approach is outlined in detail and motivated along with a real data example on six highly liquid stocks. The forecasting performance is evaluated both with respect to statistical precision and in the context of portfolio optimization. Comparisons with Cholesky decomposition based benchmark models support the excellent prediction ability of the proposed model approach.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStationary vine copula models for multivariate time series

Thomas Nagler, Aleksey Min, Daniel Krüger

A Pattern Discovery Approach to Multivariate Time Series Forecasting

Chenjuan Guo, Bin Yang, Kai Zheng et al.

DisenTS: Disentangled Channel Evolving Pattern Modeling for Multivariate Time Series Forecasting

Qi Liu, Enhong Chen, Zhi Li et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)