Summary

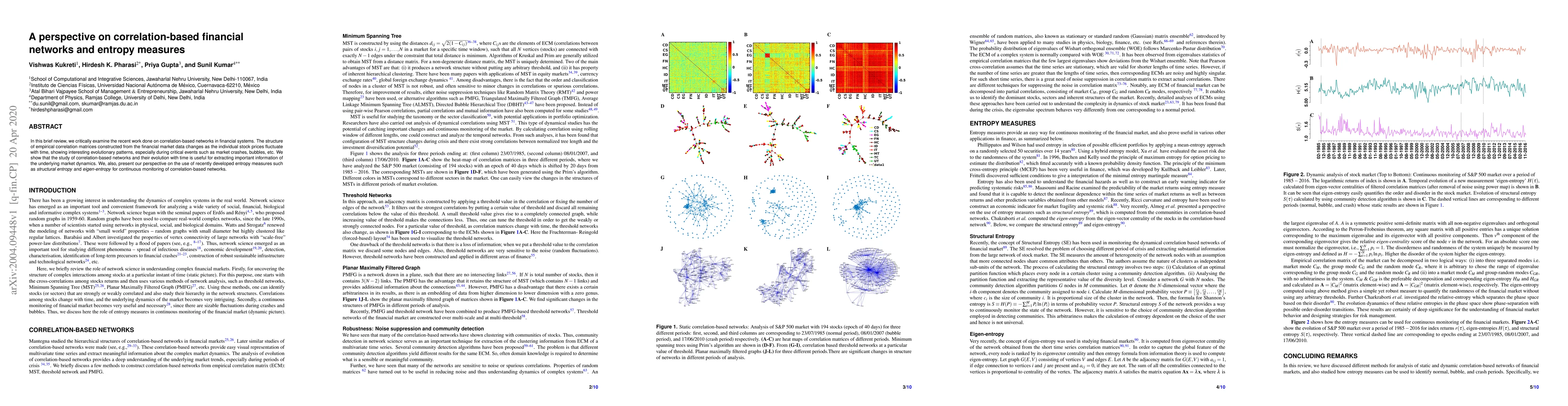

In this brief review, we critically examine the recent work done on correlation-based networks in financial systems. The structure of empirical correlation matrices constructed from the financial market data changes as the individual stock prices fluctuate with time, showing interesting evolutionary patterns, especially during critical events such as market crashes, bubbles, etc. We show that the study of correlation-based networks and their evolution with time is useful for extracting important information of the underlying market dynamics. We, also, present our perspective on the use of recently developed entropy measures such as structural entropy and eigen-entropy for continuous monitoring of correlation-based networks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGlobal Balance and Systemic Risk in Financial Correlation Networks

Fernando Diaz-Diaz, Paolo Bartesaghi, Rosanna Grassi et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)