Summary

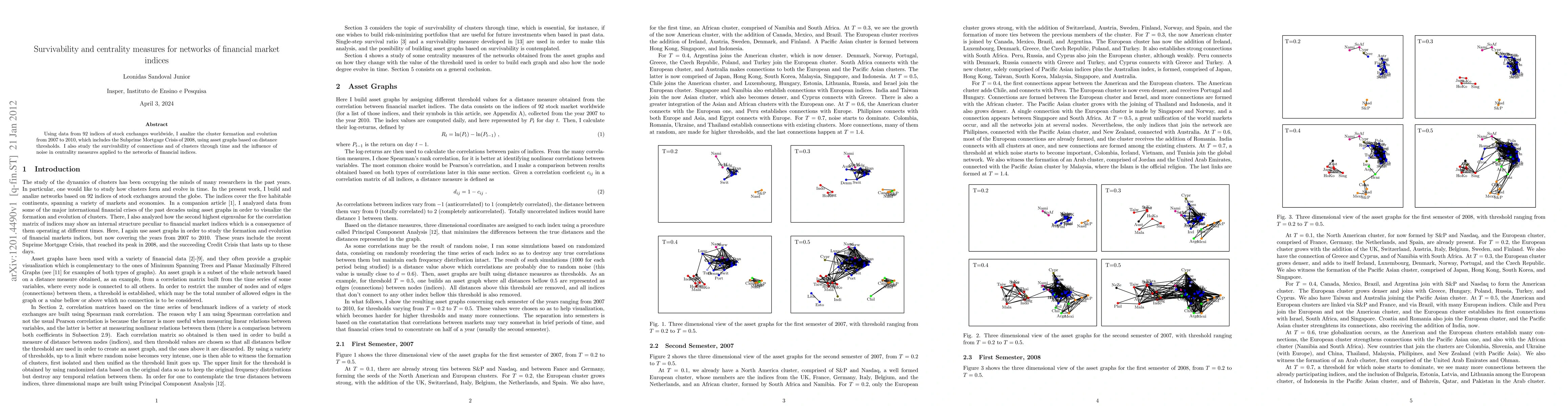

Using data from 92 indices of stock exchanges worldwide, I analize the cluster formation and evolution from 2007 to 2010, which includes the Subprime Mortgage Crisis of 2008, using asset graphs based on distance thresholds. I also study the survivability of connections and of clusters through time and the influence of noise in centrality measures applied to the networks of financial indices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Financial Market of Environmental Indices

Frank J. Fabozzi, Abootaleb Shirvani, Svetlozar Rachev et al.

The Financial Market of Indices of Socioeconomic Wellbeing

Abootaleb Shirvani, Svetlozar Rachev, Thilini V. Mahanama

| Title | Authors | Year | Actions |

|---|

Comments (0)