Summary

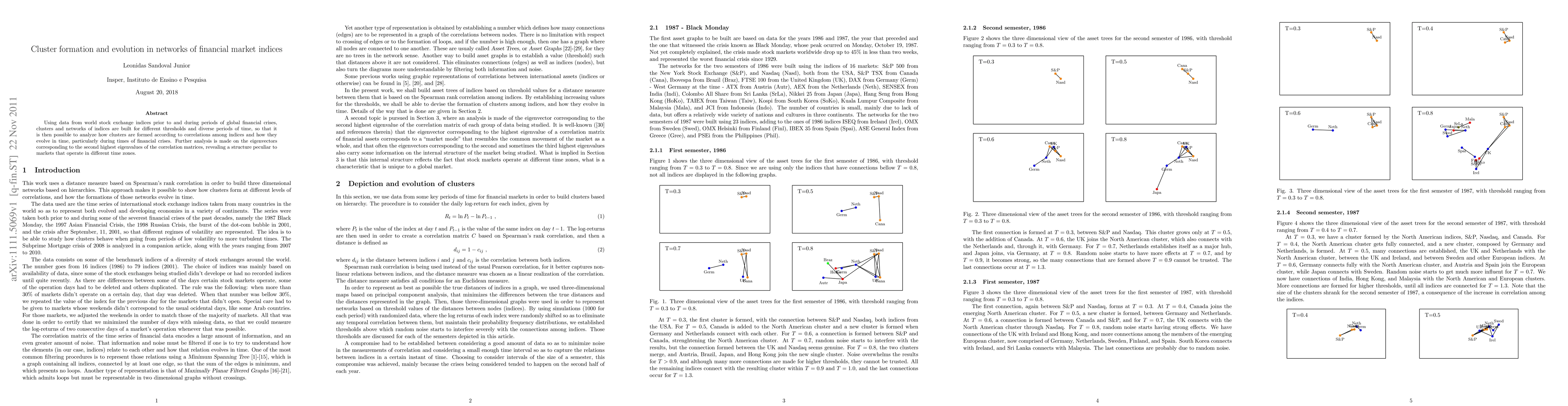

Using data from world stock exchange indices prior to and during periods of global financial crises, clusters and networks of indices are built for different thresholds and diverse periods of time, so that it is then possible to analyze how clusters are formed according to correlations among indices and how they evolve in time, particularly during times of financial crises. Further analysis is made on the eigenvectors corresponding to the second highest eigenvalues of the correlation matrices, revealing a structure peculiar to markets that operate in different time zones.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Financial Market of Environmental Indices

Frank J. Fabozzi, Abootaleb Shirvani, Svetlozar Rachev et al.

The Financial Market of Indices of Socioeconomic Wellbeing

Abootaleb Shirvani, Svetlozar Rachev, Thilini V. Mahanama

| Title | Authors | Year | Actions |

|---|

Comments (0)