Authors

Summary

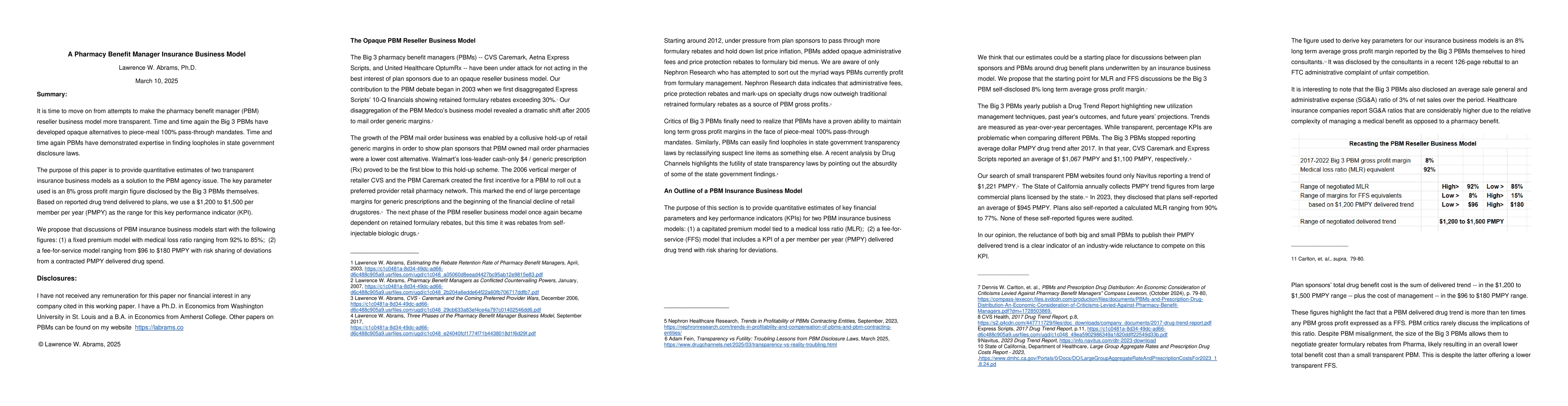

It is time to move on from attempts to make the pharmacy benefit manager (PBM) reseller business model more transparent. Time and time again the Big 3 PBMs have developed opaque alternatives to piece-meal 100% pass-through mandates. Time and time again PBMs have demonstrated expertise in finding loopholes in state government disclosure laws. The purpose of this paper is to provide quantitative estimates of two transparent insurance business models as a solution to the PBM agency issue. The key parameter used is an 8% gross profit margin figure disclosed by the Big 3 PBMs themselves. Based on reported drug trend delivered to plans, we use a $1,200 to $1,500 per member per year (PMPY) as the range for this key performance indicator (KPI). We propose that discussions of PBM insurance business models start with the following figures: (1) a fixed premium model with medical loss ratio ranging from 92% to 85%; (2) a fee-for-service model ranging from $96 to $180 PMPY with risk sharing of deviations from a contracted PMPY delivered drug spend.

AI Key Findings

Generated Jun 10, 2025

Methodology

The paper proposes quantitative estimates of two transparent insurance business models for PBMs, using a 8% gross profit margin disclosed by Big 3 PBMs and reported drug trends ranging from $1,200 to $1,500 PMPY.

Key Results

- Two transparent PBM insurance business models proposed: fixed premium model with MLR ranging from 92% to 85% and a fee-for-service model with PMPY ranging from $96 to $180 with risk sharing.

- 8% gross profit margin reported by Big 3 PBMs themselves used as a key parameter.

- Plan sponsors' total drug benefit cost consists of delivered trend ($1,200-$1,500 PMPY) plus PBM management cost ($96-$180 PMPY), with the former being more than ten times the latter.

Significance

This research aims to shift discussions around PBM drug benefit plans to transparent insurance business models, addressing the longstanding issue of PBM opacity and misaligned incentives.

Technical Contribution

The paper presents a novel approach to PBM compensation models, transitioning from opaque reseller models to transparent insurance business models with clear KPIs and risk-sharing mechanisms.

Novelty

This research distinguishes itself by proposing concrete, quantitative estimates for transparent PBM insurance business models, addressing the persistent opacity and misaligned incentives in the PBM industry.

Limitations

- Reluctance of both big and small PBMs to publish PMPY delivered trend indicates industry-wide avoidance of competing on this KPI.

- The proposed models require further research, specifically into an 8% equivalent MLR and FFS, as well as fair trade-offs between contracted FFS and risk-sharing arrangements.

Future Work

- Further research needed on an 8% equivalent MLR and FFS, as well as fair trade-offs between contracted FFS and risk-sharing arrangements.

- Explore the implications of PBM management changes under an insurance model, focusing on outcomes measurement, utilization management, and patient well-being.

Paper Details

PDF Preview

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)