Summary

Recent transformative and disruptive advancements in the insurance industry have embraced various InsurTech innovations. In particular, with the rapid progress in data science and computational capabilities, InsurTech is able to integrate a multitude of emerging data sources, shedding light on opportunities to enhance risk classification and claims management. This paper presents a groundbreaking effort as we combine real-life proprietary insurance claims information together with InsurTech data to enhance the loss model, a fundamental component of insurance companies' risk management. Our study further utilizes various machine learning techniques to quantify the predictive improvement of the InsurTech-enhanced loss model over that of the insurance in-house. The quantification process provides a deeper understanding of the value of the InsurTech innovation and advocates potential risk factors that are unexplored in traditional insurance loss modeling. This study represents a successful undertaking of an academic-industry collaboration, suggesting an inspiring path for future partnerships between industry and academic institutions.

AI Key Findings

Generated Sep 03, 2025

Methodology

This research combines real-life insurance claims data with InsurTech data to enhance loss models using machine learning techniques, demonstrating a successful academic-industry collaboration.

Key Results

- InsurTech-enhanced loss models show significant predictive improvement over traditional in-house models.

- The study identifies previously unexplored risk factors using InsurTech data, enhancing risk classification and claims management.

Significance

This research is important as it showcases the value of InsurTech innovation in improving loss models, which can lead to better risk management, premium determination, and overall financial health for insurance companies.

Technical Contribution

The paper presents a novel approach to integrating diverse data sources and applying machine learning techniques to improve loss models in the insurance industry.

Novelty

This work stands out by demonstrating the practical benefits of combining internal insurance data with external InsurTech data, leading to enhanced risk classification and claims management.

Limitations

- The study is limited to Business Owner Policies (BOP) and may not generalize to other types of insurance.

- Regulatory compliance for premium rating and risk classification might pose challenges in adopting these findings.

Future Work

- Explore the application of these findings across various lines of insurance beyond BOP.

- Investigate the regulatory approval process for using InsurTech-driven risk factors in premium rating and risk classification.

Paper Details

PDF Preview

Key Terms

Citation Network

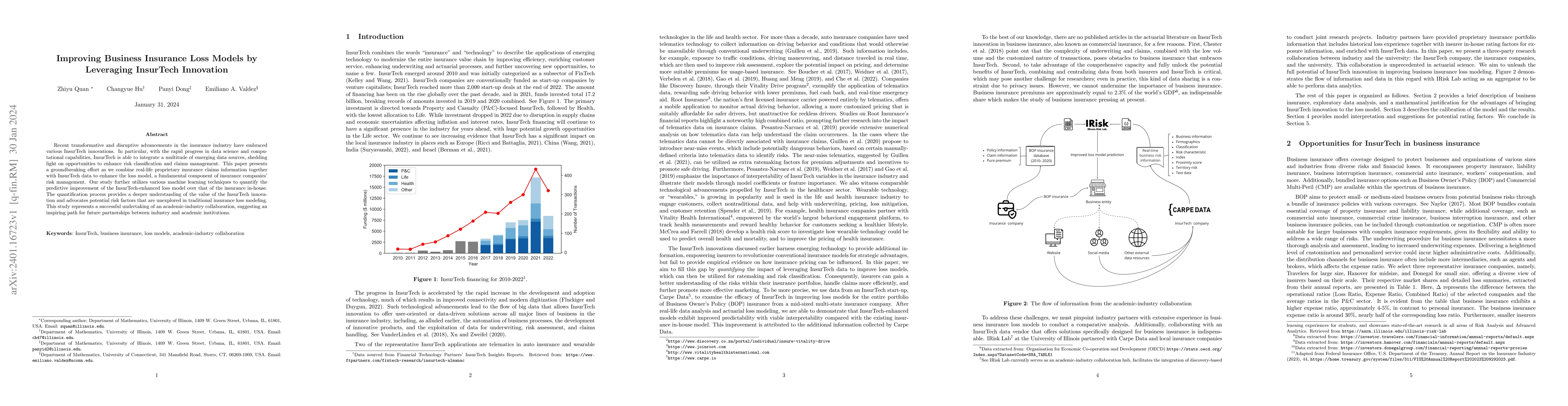

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTransforming Business with Generative AI: Research, Innovation, Market Deployment and Future Shifts in Business Models

Narotam Singh, Vaibhav Chaudhary, Nimisha Singh et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)