Summary

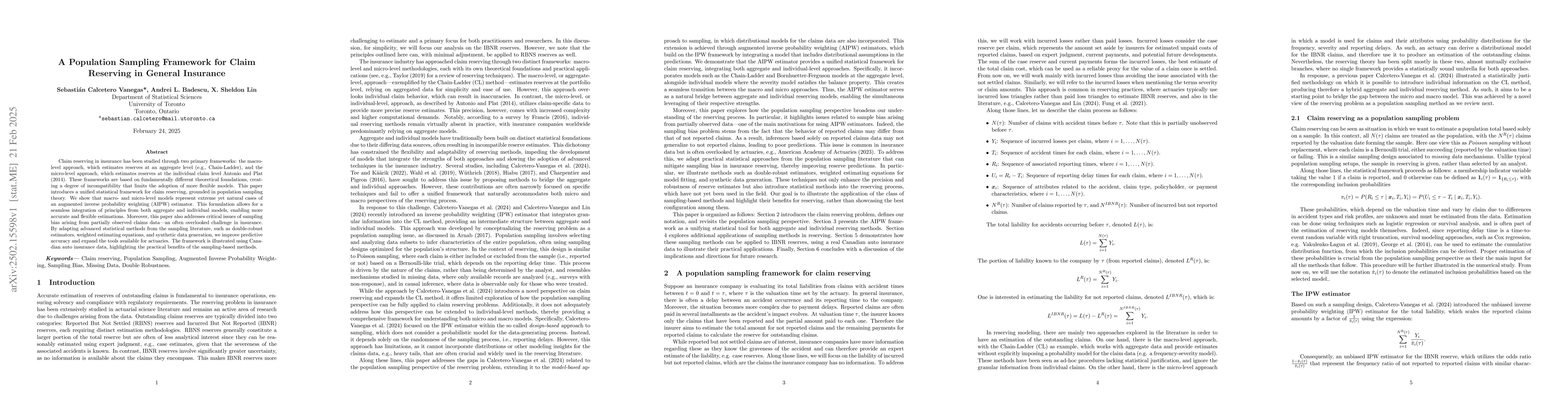

Claim reserving in insurance has been studied through two primary frameworks: the macro-level approach, which estimates reserves at an aggregate level (e.g., Chain-Ladder), and the micro-level approach, which estimates reserves at the individual claim level Antonio and Plat (2014). These frameworks are based on fundamentally different theoretical foundations, creating a degree of incompatibility that limits the adoption of more flexible models. This paper introduces a unified statistical framework for claim reserving, grounded in population sampling theory. We show that macro- and micro-level models represent extreme yet natural cases of an augmented inverse probability weighting (AIPW) estimator. This formulation allows for a seamless integration of principles from both aggregate and individual models, enabling more accurate and flexible estimations. Moreover, this paper also addresses critical issues of sampling bias arising from partially observed claims data-an often overlooked challenge in insurance. By adapting advanced statistical methods from the sampling literature, such as double-robust estimators, weighted estimating equations, and synthetic data generation, we improve predictive accuracy and expand the tools available for actuaries. The framework is illustrated using Canadian auto insurance data, highlighting the practical benefits of the sampling-based methods.

AI Key Findings

Generated Jun 11, 2025

Methodology

The research introduces a unified statistical framework for claim reserving in insurance, grounded in population sampling theory, integrating principles from both aggregate and individual models to improve accuracy and flexibility.

Key Results

- Macro- and micro-level models are shown to be extreme cases of an augmented inverse probability weighting (AIPW) estimator.

- Advanced statistical methods from sampling literature, such as double-robust estimators and weighted estimating equations, improve predictive accuracy.

- The framework addresses sampling bias issues arising from partially observed claims data.

- Illustrated using Canadian auto insurance data, highlighting practical benefits of sampling-based methods.

Significance

This work is significant as it unifies existing claim reserving frameworks, improves estimation accuracy, and provides actuaries with more robust tools to handle the challenges posed by partially observed claims data.

Technical Contribution

The paper presents a novel statistical framework for claim reserving that unifies macro- and micro-level approaches through the lens of population sampling theory and AIPW estimators.

Novelty

The research distinguishes itself by bridging the gap between aggregate and individual claim reserving models, offering a more flexible and accurate estimation approach grounded in advanced statistical sampling methods.

Limitations

- The study is based on Canadian auto insurance data, which may limit generalizability to other insurance sectors or geographies.

- While the paper demonstrates the effectiveness of the proposed framework, further research is needed to validate its performance across diverse datasets and scenarios.

Future Work

- Exploring the application of the framework to other types of insurance (e.g., health, life, property).

- Investigating the performance of the proposed methods under various economic conditions and claim frequency scenarios.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMicro-level Reserving for General Insurance Claims using a Long Short-Term Memory Network

Hélène Cossette, Marie-Pier Côté, Ihsan Chaoubi et al.

Claim Reserving via Inverse Probability Weighting: A Micro-Level Chain-Ladder Method

Sebastian Calcetero-Vanegas, Andrei L. Badescu, X. Sheldon Lin

No citations found for this paper.

Comments (0)