Summary

This paper presents a simple method for a posteriori (historical) multi-variate multi-stage optimal trading under transaction costs and a diversification constraint. Starting from a given amount of money in some currency, we analyze the stage-wise optimal allocation over a time horizon with potential investments in multiple currencies and various assets. Three variants are discussed, including unconstrained trading frequency, a fixed number of total admissable trades, and the waiting of a specific time-period after every executed trade until the next trade. The developed methods are based on efficient graph generation and consequent graph search, and are evaluated quantitatively on real-world data. The fundamental motivation of this work is preparatory labeling of financial time-series data for supervised machine learning.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

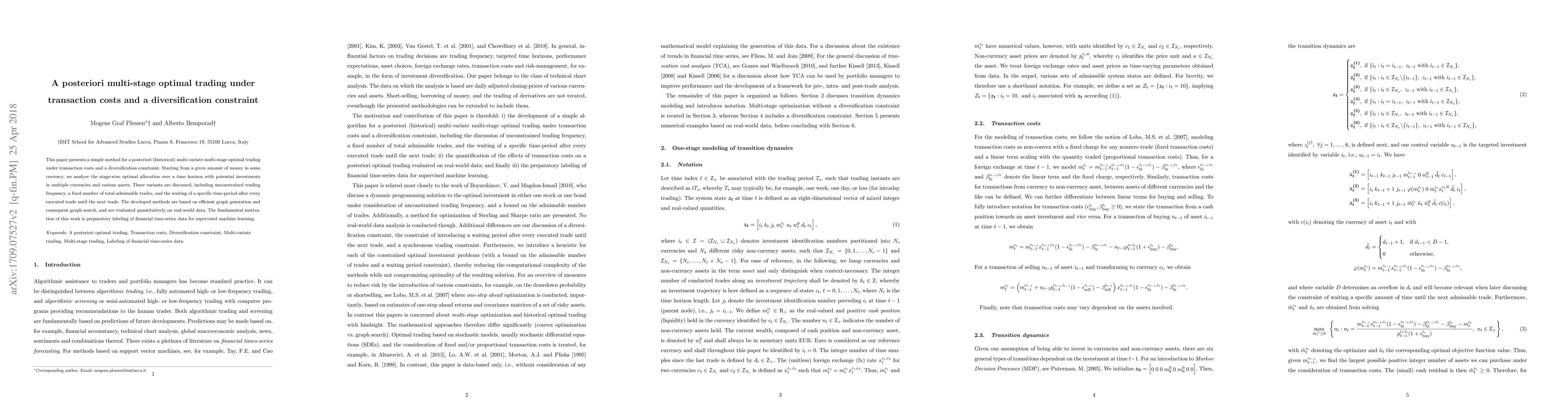

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)