Summary

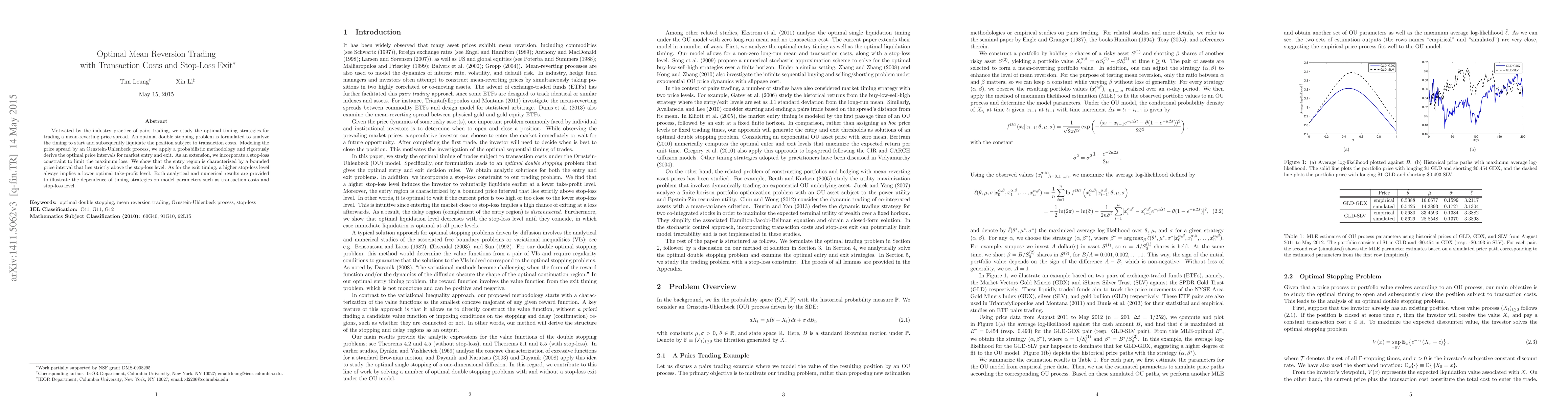

Motivated by the industry practice of pairs trading, we study the optimal timing strategies for trading a mean-reverting price spread. An optimal double stopping problem is formulated to analyze the timing to start and subsequently liquidate the position subject to transaction costs. Modeling the price spread by an Ornstein-Uhlenbeck process, we apply a probabilistic methodology and rigorously derive the optimal price intervals for market entry and exit. As an extension, we incorporate a stop-loss constraint to limit the maximum loss. We show that the entry region is characterized by a bounded price interval that lies strictly above the stop-loss level. As for the exit timing, a higher stop-loss level always implies a lower optimal take-profit level. Both analytical and numerical results are provided to illustrate the dependence of timing strategies on model parameters such as transaction cost and stop-loss level.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)