Summary

We study the optimal timing strategies for trading a mean-reverting price process with afinite deadline to enter and a separate finite deadline to exit the market. The price process is modeled by a diffusion with an affine drift that encapsulates a number of well-known models,including the Ornstein-Uhlenbeck (OU) model, Cox-Ingersoll-Ross (CIR) model, Jacobi model,and inhomogeneous geometric Brownian motion (IGBM) model.We analyze three types of trading strategies: (i) the long-short (long to open, short to close) strategy; (ii) the short-long(short to open, long to close) strategy, and (iii) the chooser strategy whereby the trader has the added flexibility to enter the market by taking either a long or short position, and subsequently close the position. For each strategy, we solve an optimal double stopping problem with sequential deadlines, and determine the optimal timing of trades. Our solution methodology utilizes the local time-space calculus of Peskir (2005) to derive nonlinear integral equations of Volterra-type that uniquely characterize the trading boundaries. Numerical implementation ofthe integral equations provides examples of the optimal trading boundaries.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

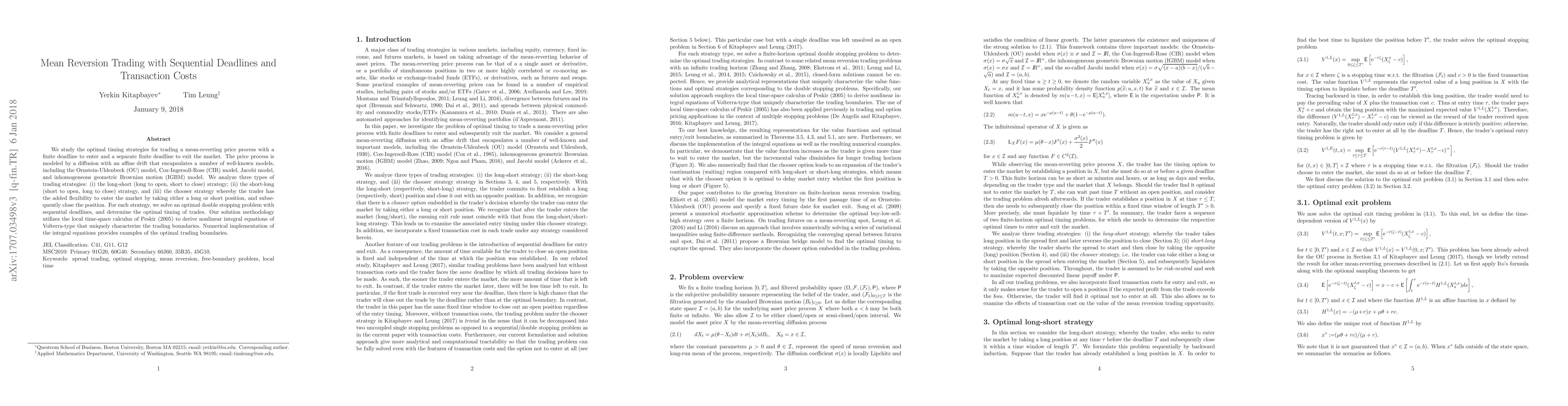

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)