Summary

We consider the valuation of contingent claims with delayed dynamics in a Black&Scholes complete market model. We find a pricing formula that can be decomposed into terms reflecting the market values of the past and the present, showing how the valuation of future cashflows cannot abstract away from the contribution of the past. As a practical application, we provide an explicit expression for the market value of human capital in a setting with wage rigidity. The formula we derive has successfully been used to explicitly solve the infinite dimensional stochastic control problems addressed in different settings.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

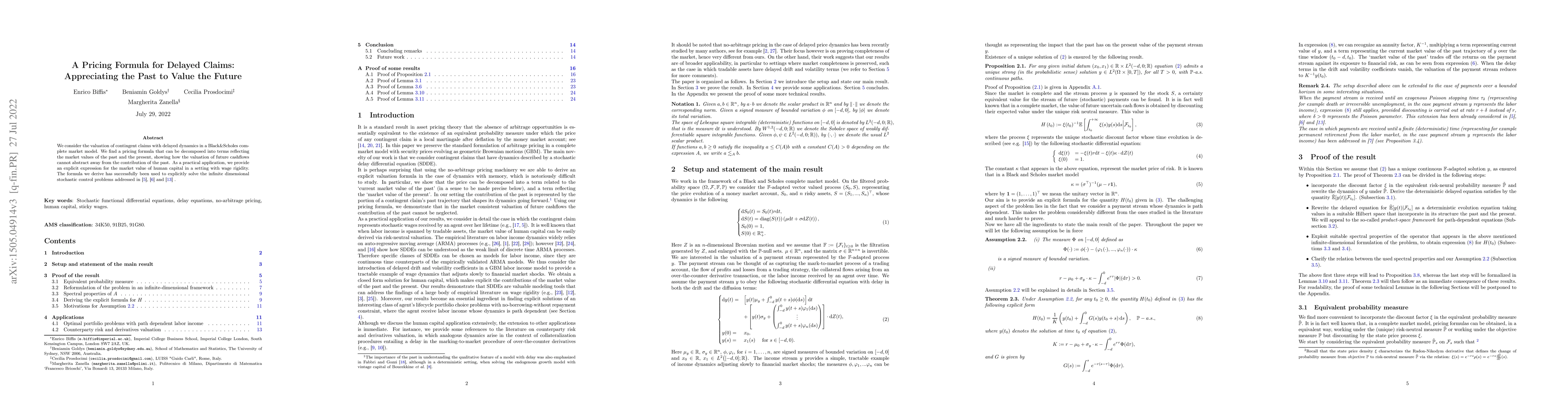

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)