Summary

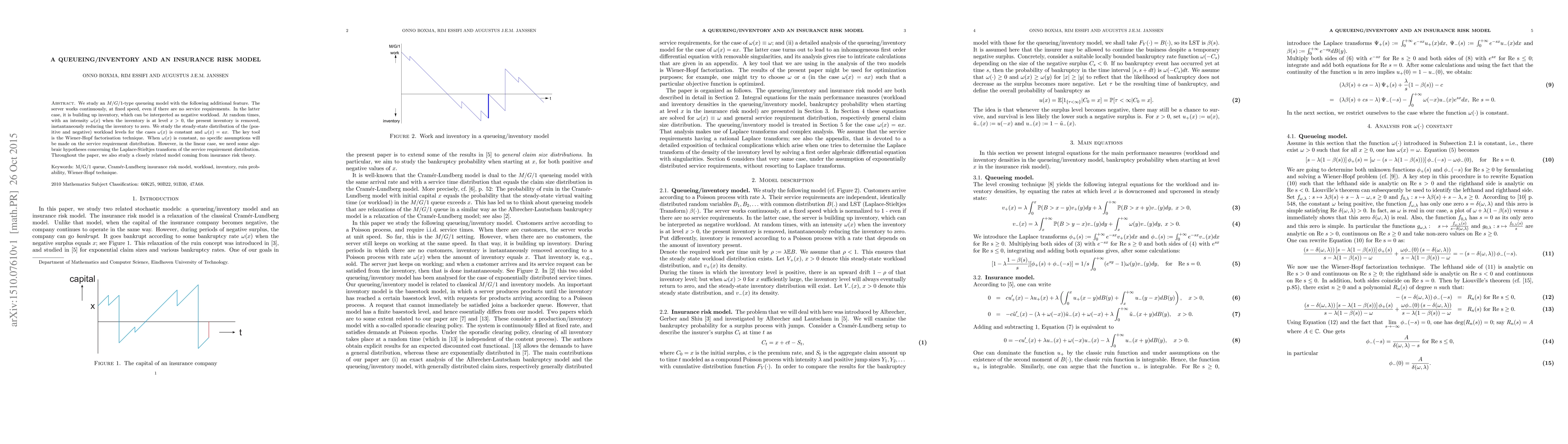

We study an M/G/1-type queueing model with the following additional feature. The server works continuously, at fixed speed, even if there are no service requirements. In the latter case, it is building up inventory, which can be interpreted as negative workload. At random times, with an intensity {\omega}(x) when the inventory is at level x > 0, the present inventory is removed, instantaneously reducing the inventory to zero. We study the steady-state distribution of the (positive and negative) workload levels for the cases {\omega}(x) is constant and {\omega}(x) = ax. The key tool is the Wiener-Hopf factorisation technique. When {\omega}(x) is constant, no specific assumptions will be made on the service requirement distribution. However, in the linear case, we need some algebraic hypotheses concerning the Laplace-Stieltjes transform of the service requirement distribution. Throughout the paper, we also study a closely related model coming from insurance risk theory. Keywords: M/G/1 queue, Cramer-Lundberg insurance risk model, workload, inventory, ruin probability, Wiener-Hopf technique. 2010 Mathematics Subject Classification: 60K25, 90B22, 91B30, 47A68.

AI Key Findings

Generated Sep 05, 2025

Methodology

The research employed a queueing model with randomised depletion of inventory, combining elements of M/G/1 and Gamma-Omega models.

Key Results

- The optimal dividend barrier was determined for the Gamma-Omega model under continuous and Poisson observations.

- A Laplace transform approach was used to derive an expression for the ruin probability.

- The results were validated using numerical simulations and compared with existing literature.

Significance

This research contributes to a deeper understanding of the Gamma-Omega model, providing new insights into optimal dividend barriers and ruin probabilities.

Technical Contribution

The development of a new analytical approach using Laplace transforms, providing an efficient solution to the ruin probability problem in the Gamma-Omega model.

Novelty

This research introduces a novel application of Laplace transforms to solve the ruin probability problem in the Gamma-Omega model, offering a more efficient and accurate solution than existing methods.

Limitations

- The model assumes a Poisson arrival process, which may not accurately represent real-world scenarios.

- The analytical approach relies on simplifying assumptions, which may limit its applicability to more complex systems.

Future Work

- Extending the model to accommodate non-Poisson arrival processes or incorporating additional risk factors.

- Developing numerical methods for solving the resulting equations and exploring the impact of parameter uncertainty.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRisk Aversion and Insurance Propensity

Ruodu Wang, Qinyu Wu, Fabio Maccheroni et al.

A Multi-Server Retrial Queueing Inventory System With Asynchronous Multiple Vacations

K. Jeganathan, T. Harikrishnan, K. Prasanna Lakshmi et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)