Authors

Summary

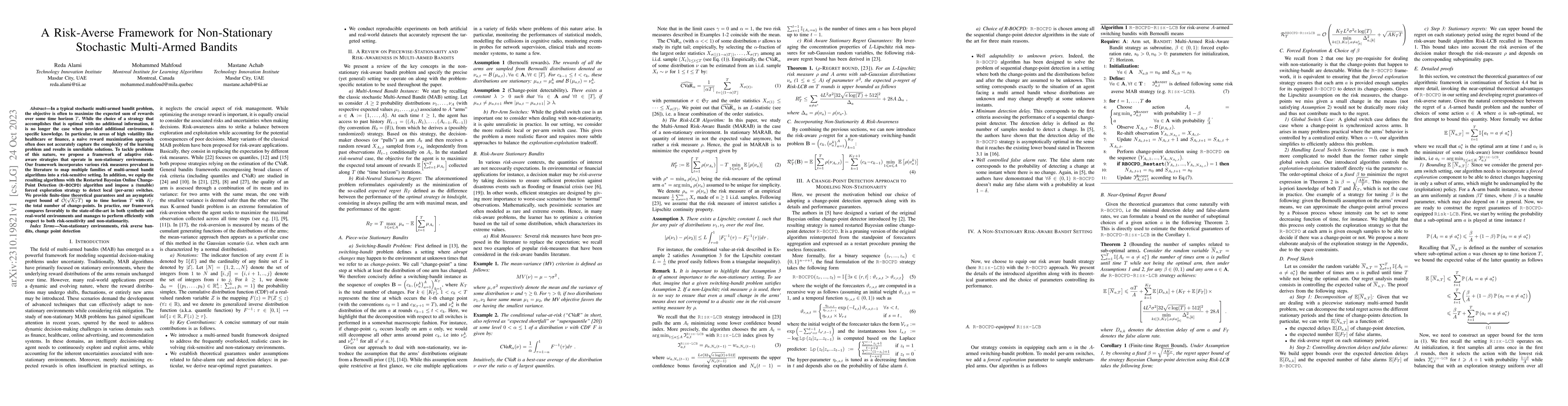

In a typical stochastic multi-armed bandit problem, the objective is often to maximize the expected sum of rewards over some time horizon $T$. While the choice of a strategy that accomplishes that is optimal with no additional information, it is no longer the case when provided additional environment-specific knowledge. In particular, in areas of high volatility like healthcare or finance, a naive reward maximization approach often does not accurately capture the complexity of the learning problem and results in unreliable solutions. To tackle problems of this nature, we propose a framework of adaptive risk-aware strategies that operate in non-stationary environments. Our framework incorporates various risk measures prevalent in the literature to map multiple families of multi-armed bandit algorithms into a risk-sensitive setting. In addition, we equip the resulting algorithms with the Restarted Bayesian Online Change-Point Detection (R-BOCPD) algorithm and impose a (tunable) forced exploration strategy to detect local (per-arm) switches. We provide finite-time theoretical guarantees and an asymptotic regret bound of order $\tilde O(\sqrt{K_T T})$ up to time horizon $T$ with $K_T$ the total number of change-points. In practice, our framework compares favorably to the state-of-the-art in both synthetic and real-world environments and manages to perform efficiently with respect to both risk-sensitivity and non-stationarity.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Adaptive Method for Non-Stationary Stochastic Multi-armed Bandits with Rewards Generated by a Linear Dynamical System

Mehdi Hosseinzadeh, Jonathan Gornet, Bruno Sinopoli

No citations found for this paper.

Comments (0)