Summary

This paper tackles the risk averse multi-armed bandits problem when incurred losses are non-stationary. The conditional value-at-risk (CVaR) is used as the objective function. Two estimation methods are proposed for this objective function in the presence of non-stationary losses, one relying on a weighted empirical distribution of losses and another on the dual representation of the CVaR. Such estimates can then be embedded into classic arm selection methods such as epsilon-greedy policies. Simulation experiments assess the performance of the arm selection algorithms based on the two novel estimation approaches, and such policies are shown to outperform naive benchmarks not taking non-stationarity into account.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

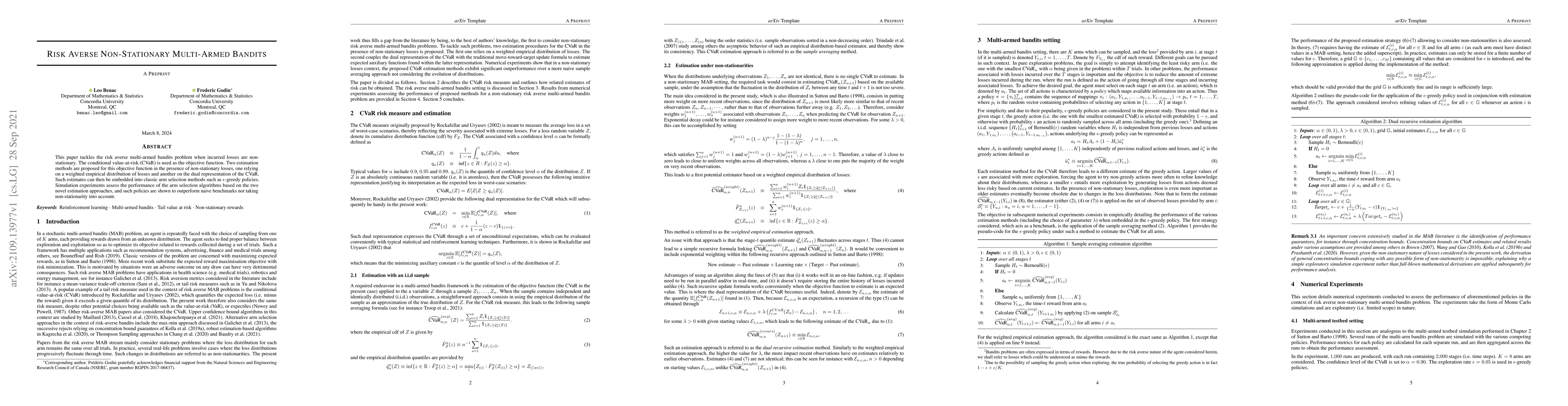

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Risk-Averse Framework for Non-Stationary Stochastic Multi-Armed Bandits

Reda Alami, Mastane Achab, Mohammed Mahfoud

| Title | Authors | Year | Actions |

|---|

Comments (0)