Authors

Summary

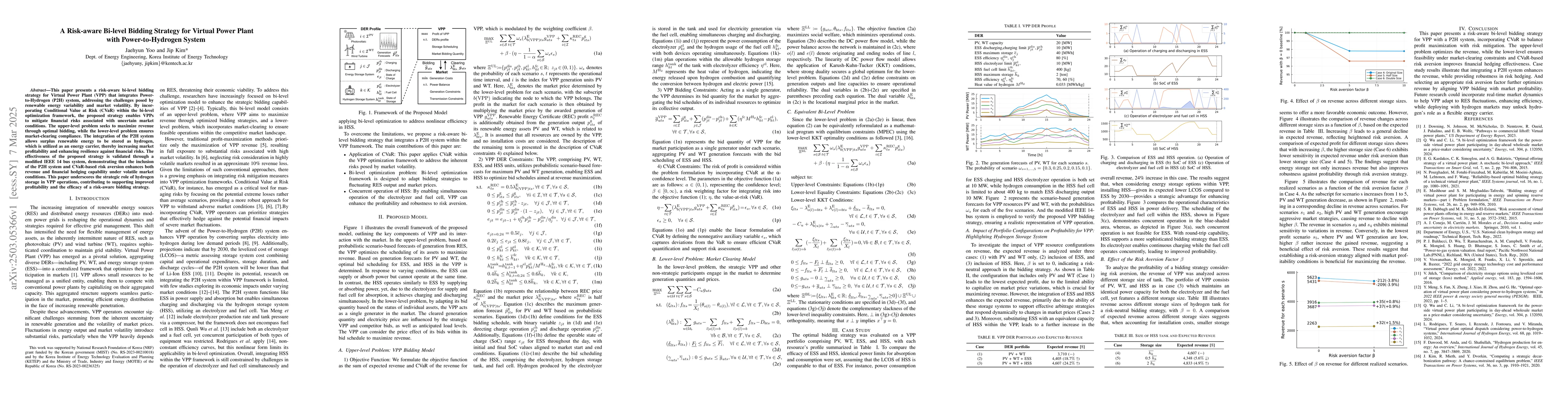

This paper presents a risk-aware bi-level bidding strategy for Virtual Power Plant (VPP) that integrates Power-to-Hydrogen (P2H) system, addressing the challenges posed by renewable energy variability and market volatility. By incorporating Conditional Value at Risk (CVaR) within the bi-level optimization framework, the proposed strategy enables VPPs to mitigate financial risks associated with uncertain market conditions. The upper-level problem seeks to maximize revenue through optimal bidding, while the lower-level problem ensures market-clearing compliance. The integration of the P2H system allows surplus renewable energy to be stored as hydrogen, which is utilized as an energy carrier, thereby increasing market profitability and enhancing resilience against financial risks. The effectiveness of the proposed strategy is validated through a modified IEEE 14 bus system, demonstrating that the inclusion of the P2H system and CVaR-based risk aversion enhances both revenue and financial hedging capability under volatile market conditions.This paper underscores the strategic role of hydrogen storage in VPP operations, contributing to supporting improved profitability and the efficacy of a risk-aware bidding strategy.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research employs a bi-level optimization framework integrating a Power-to-Hydrogen (P2H) system within a Virtual Power Plant (VPP) to develop a risk-aware bidding strategy. It uses Conditional Value at Risk (CVaR) to address market volatility and renewable energy variability, optimizing revenue while ensuring market-clearing compliance.

Key Results

- The proposed strategy enhances both revenue and financial hedging capability under volatile market conditions.

- Incorporating a P2H system allows surplus renewable energy to be stored as hydrogen, increasing market profitability and resilience against financial risks.

- Simultaneous operation of the electrolyzer and fuel cell in the HSS enhances VPP profitability and robustness against risks.

- The case study demonstrates that installing HSS, given its expected lower Levelized Cost of Storage (LCOS) compared to ESS by 2030, provides a strategic advantage for enhancing profitability.

Significance

This research is significant as it underscores the strategic role of hydrogen storage in VPP operations, contributing to improved profitability and the efficacy of a risk-aware bidding strategy, which is crucial for the integration of renewable energy sources into the power grid.

Technical Contribution

The paper presents a bi-level bidding strategy for VPP with a P2H system, integrating CVaR to balance profit maximization with risk mitigation, ensuring market-clearing constraints are met.

Novelty

This work is novel by applying CVaR within the VPP optimization framework to address inherent market risks and by demonstrating the simultaneous operation of electrolyzer and fuel cell in HSS for enhanced profitability and risk aversion.

Limitations

- The study is based on a modified IEEE 14 bus system, which may not fully represent the complexities of real-world power grids.

- The analysis assumes risk-neutral and risk-averse approaches without considering intermediate levels of risk tolerance.

Future Work

- Incorporating real-time market dynamics to help VPP adapt to renewable energy source fluctuations.

- Exploring the deployment of VPP with hydrogen markets to unlock hydrogen's role as a flexible energy carrier.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMulti-timescale Trading Strategy for Renewable Power to Ammonia Virtual Power Plant in the Electricity, Hydrogen, and Ammonia Markets

Feng Liu, Yonghua Song, Xiang Cheng et al.

Single-level Robust Bidding of Renewable-only Virtual Power Plant in Energy and Ancillary Service Markets for Worst-case Profit

Hadi Nemati, Pedro Sánchez-Martín, Ana Baringo et al.

Betting vs. Trading: Learning a Linear Decision Policy for Selling Wind Power and Hydrogen

Jalal Kazempour, Farzaneh Pourahmadi, Yannick Heiser

Risk-Aware Value-Oriented Net Demand Forecasting for Virtual Power Plants

Yuanyuan Shi, Yufan Zhang, Jiajun Han

No citations found for this paper.

Comments (0)