Summary

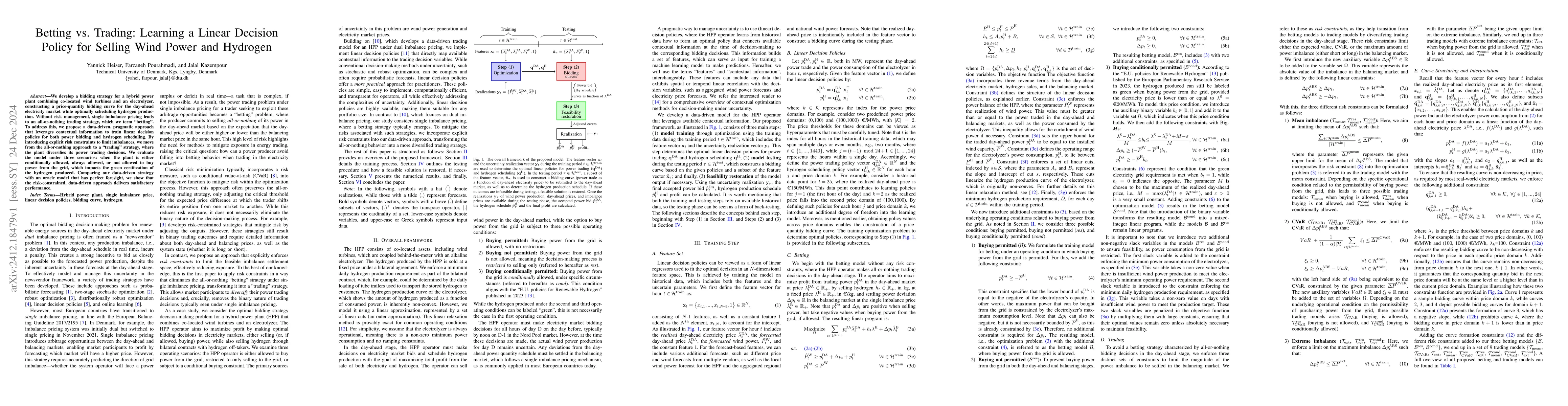

We develop a bidding strategy for a hybrid power plant combining co-located wind turbines and an electrolyzer, constructing a price-quantity bidding curve for the day-ahead electricity market while optimally scheduling hydrogen production. Without risk management, single imbalance pricing leads to an all-or-nothing trading strategy, which we term 'betting'. To address this, we propose a data-driven, pragmatic approach that leverages contextual information to train linear decision policies for both power bidding and hydrogen scheduling. By introducing explicit risk constraints to limit imbalances, we move from the all-or-nothing approach to a 'trading" strategy', where the plant diversifies its power trading decisions. We evaluate the model under three scenarios: when the plant is either conditionally allowed, always allowed, or not allowed to buy power from the grid, which impacts the green certification of the hydrogen produced. Comparing our data-driven strategy with an oracle model that has perfect foresight, we show that the risk-constrained, data-driven approach delivers satisfactory performance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersFeature-Driven Strategies for Trading Wind Power and Hydrogen

Jalal Kazempour, Lesia Mitridati, Emil Helgren

Pairs Trading: An Optimal Selling Rule with Constraints

Qing Zhang, Zhen Wu, Ruyi Liu et al.

Online Decision Making for Trading Wind Energy

Jalal Kazempour, Pierre Pinson, Miguel Angel Muñoz

No citations found for this paper.

Comments (0)