Summary

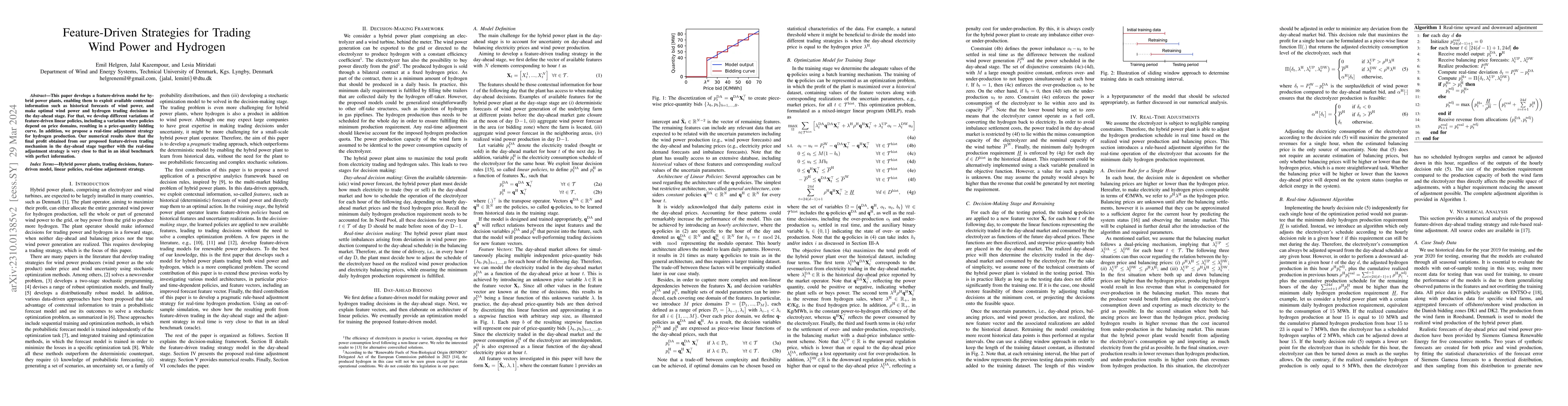

This paper develops a feature-driven model for hybrid power plants, enabling them to exploit available contextual information such as historical forecasts of wind power, and make optimal wind power and hydrogen trading decisions in the day-ahead stage. For that, we develop different variations of feature-driven linear policies, including a variation where policies depend on price domains, resulting in a price-quantity bidding curve. In addition, we propose a real-time adjustment strategy for hydrogen production. Our numerical results show that the final profit obtained from our proposed feature-driven trading mechanism in the day-ahead stage together with the real-time adjustment strategy is very close to that in an ideal benchmark with perfect information.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBetting vs. Trading: Learning a Linear Decision Policy for Selling Wind Power and Hydrogen

Jalal Kazempour, Farzaneh Pourahmadi, Yannick Heiser

Multi-timescale Trading Strategy for Renewable Power to Ammonia Virtual Power Plant in the Electricity, Hydrogen, and Ammonia Markets

Feng Liu, Yonghua Song, Xiang Cheng et al.

Online Decision Making for Trading Wind Energy

Jalal Kazempour, Pierre Pinson, Miguel Angel Muñoz

| Title | Authors | Year | Actions |

|---|

Comments (0)