Summary

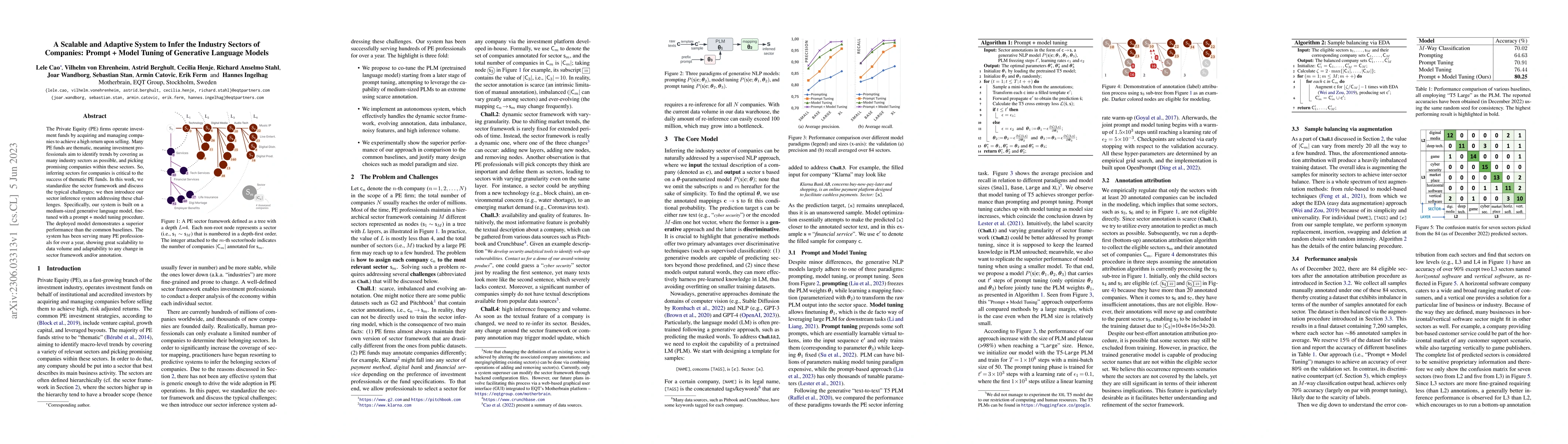

The Private Equity (PE) firms operate investment funds by acquiring and managing companies to achieve a high return upon selling. Many PE funds are thematic, meaning investment professionals aim to identify trends by covering as many industry sectors as possible, and picking promising companies within these sectors. So, inferring sectors for companies is critical to the success of thematic PE funds. In this work, we standardize the sector framework and discuss the typical challenges; we then introduce our sector inference system addressing these challenges. Specifically, our system is built on a medium-sized generative language model, finetuned with a prompt + model tuning procedure. The deployed model demonstrates a superior performance than the common baselines. The system has been serving many PE professionals for over a year, showing great scalability to data volume and adaptability to any change in sector framework and/or annotation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPrompt Tuning for Generative Multimodal Pretrained Models

Junyang Lin, Chang Zhou, Peng Wang et al.

PromptKD: Distilling Student-Friendly Knowledge for Generative Language Models via Prompt Tuning

Eunho Yang, Gyeongman Kim, Doohyuk Jang

Does Prompt-Tuning Language Model Ensure Privacy?

Wei Dai, Kim Laine, Esha Ghosh et al.

SpeechPrompt: An Exploration of Prompt Tuning on Generative Spoken Language Model for Speech Processing Tasks

Hung-yi Lee, Kai-Wei Chang, Shang-Wen Li et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)