Vilhelm von Ehrenheim

7 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Self-Supervised Learning of Time Series Representation via Diffusion Process and Imputation-Interpolation-Forecasting Mask

Time Series Representation Learning (TSRL) focuses on generating informative representations for various Time Series (TS) modeling tasks. Traditional Self-Supervised Learning (SSL) methods in TSRL fal...

Beyond Gut Feel: Using Time Series Transformers to Find Investment Gems

This paper addresses the growing application of data-driven approaches within the Private Equity (PE) industry, particularly in sourcing investment targets (i.e., companies) for Venture Capital (VC)...

Prompt Tuned Embedding Classification for Multi-Label Industry Sector Allocation

Prompt Tuning is emerging as a scalable and cost-effective method to fine-tune Pretrained Language Models (PLMs), which are often referred to as Large Language Models (LLMs). This study benchmarks t...

CompanyKG: A Large-Scale Heterogeneous Graph for Company Similarity Quantification

In the investment industry, it is often essential to carry out fine-grained company similarity quantification for a range of purposes, including market mapping, competitor analysis, and mergers and ...

A Scalable and Adaptive System to Infer the Industry Sectors of Companies: Prompt + Model Tuning of Generative Language Models

The Private Equity (PE) firms operate investment funds by acquiring and managing companies to achieve a high return upon selling. Many PE funds are thematic, meaning investment professionals aim to ...

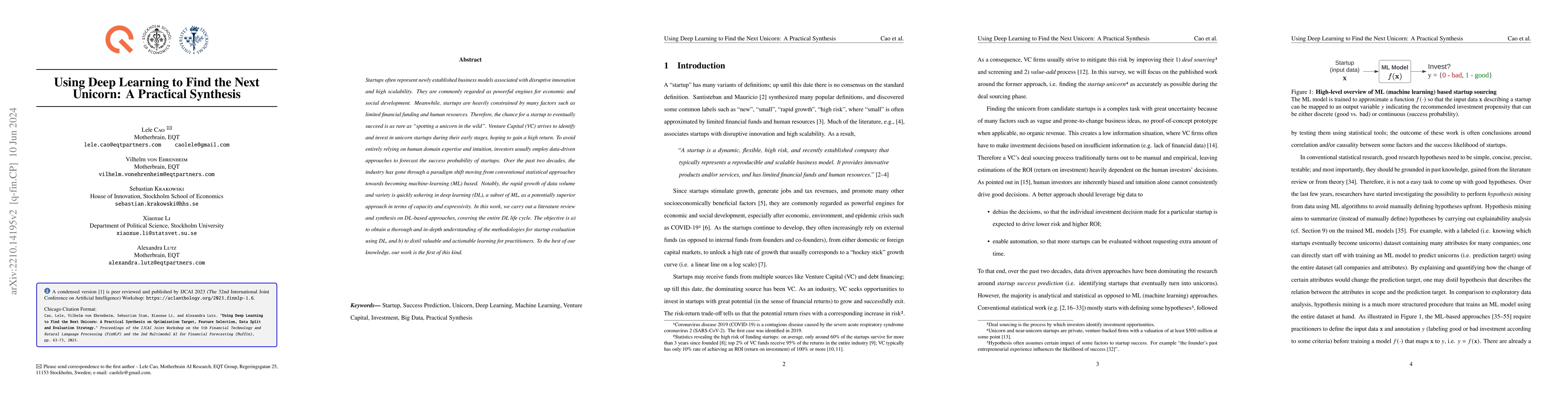

Using Deep Learning to Find the Next Unicorn: A Practical Synthesis

Startups often represent newly established business models associated with disruptive innovation and high scalability. They are commonly regarded as powerful engines for economic and social developm...

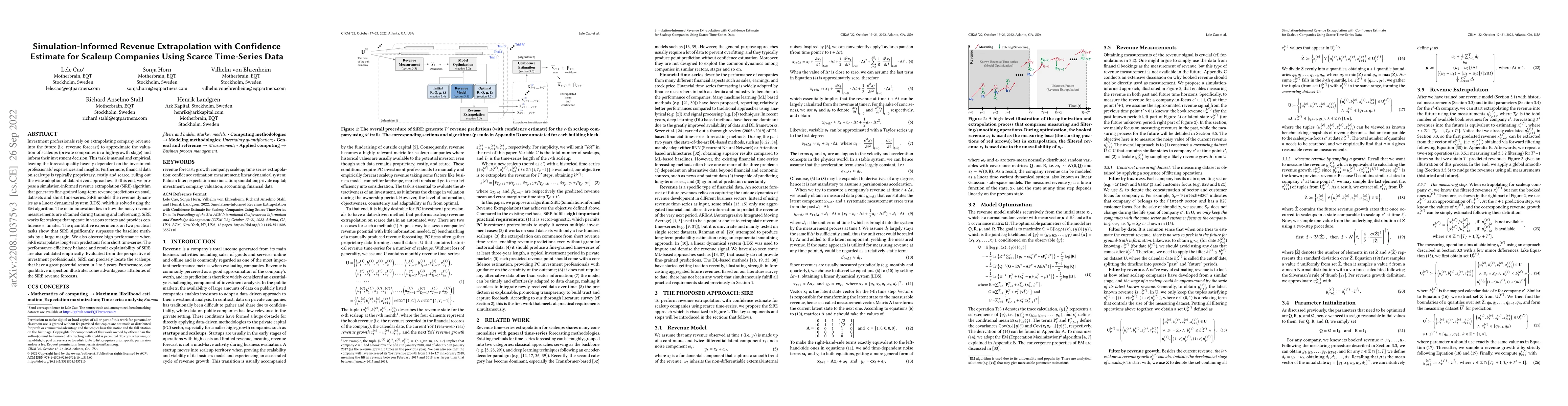

Simulation-Informed Revenue Extrapolation with Confidence Estimate for Scaleup Companies Using Scarce Time-Series Data

Investment professionals rely on extrapolating company revenue into the future (i.e. revenue forecast) to approximate the valuation of scaleups (private companies in a high-growth stage) and inform ...