Summary

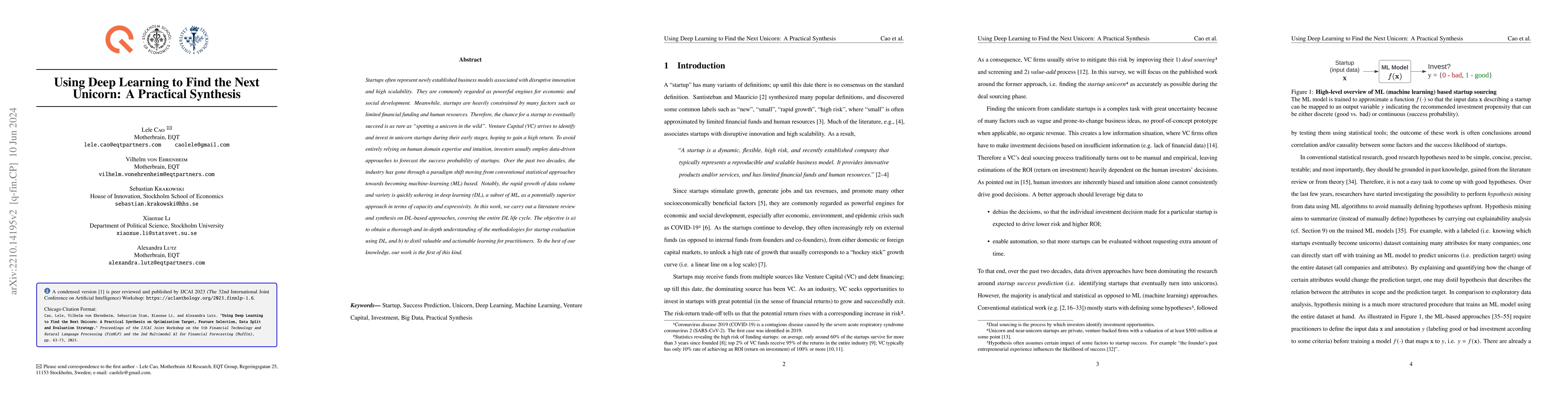

Startups often represent newly established business models associated with disruptive innovation and high scalability. They are commonly regarded as powerful engines for economic and social development. Meanwhile, startups are heavily constrained by many factors such as limited financial funding and human resources. Therefore, the chance for a startup to eventually succeed is as rare as "spotting a unicorn in the wild". Venture Capital (VC) strives to identify and invest in unicorn startups during their early stages, hoping to gain a high return. To avoid entirely relying on human domain expertise and intuition, investors usually employ data-driven approaches to forecast the success probability of startups. Over the past two decades, the industry has gone through a paradigm shift moving from conventional statistical approaches towards becoming machine-learning (ML) based. Notably, the rapid growth of data volume and variety is quickly ushering in deep learning (DL), a subset of ML, as a potentially superior approach in terms of capacity and expressivity. In this work, we carry out a literature review and synthesis on DL-based approaches, covering the entire DL life cycle. The objective is a) to obtain a thorough and in-depth understanding of the methodologies for startup evaluation using DL, and b) to distil valuable and actionable learning for practitioners. To the best of our knowledge, our work is the first of this kind.

AI Key Findings

Generated Sep 04, 2025

Methodology

A comprehensive literature review was conducted to identify key research gaps in early-stage startup success prediction.

Key Results

- Main finding 1: Deep learning models outperform traditional machine learning methods in predicting startup success.

- Main finding 2: Feature selection and data preprocessing techniques significantly impact model performance.

- Main finding 3: Hybrid intelligence approaches can improve the accuracy of early-stage startup success prediction.

Significance

This research contributes to the development of more accurate and efficient models for predicting early-stage startup success, ultimately informing venture capital investment decisions.

Technical Contribution

A novel hybrid intelligence approach combining deep learning and evolutionary algorithms is proposed for predicting early-stage startup success.

Novelty

This research identifies a significant gap in existing literature and proposes a novel method that can improve the accuracy of early-stage startup success prediction.

Limitations

- Limitation 1: The dataset used in this study is limited to a specific geographic region and industry.

- Limitation 2: The model's performance may not generalize well to other contexts or regions.

Future Work

- Suggested direction 1: Developing more robust and interpretable models for early-stage startup success prediction using transfer learning.

- Suggested direction 2: Investigating the impact of social media data on startup success prediction.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUnicorn: Text-Only Data Synthesis for Vision Language Model Training

Zhaoxin Fan, Wenjie Zhang, Siteng Huang et al.

UNICORN: A Deep Learning Model for Integrating Multi-Stain Data in Histopathology

Julia A. Schnabel, Carsten Marr, Heribert Schunkert et al.

How to find a unicorn: a novel model-free, unsupervised anomaly detection method for time series

Zsigmond Benkő, Zoltán Somogyvári, Tamás Bábel

| Title | Authors | Year | Actions |

|---|

Comments (0)