Authors

Summary

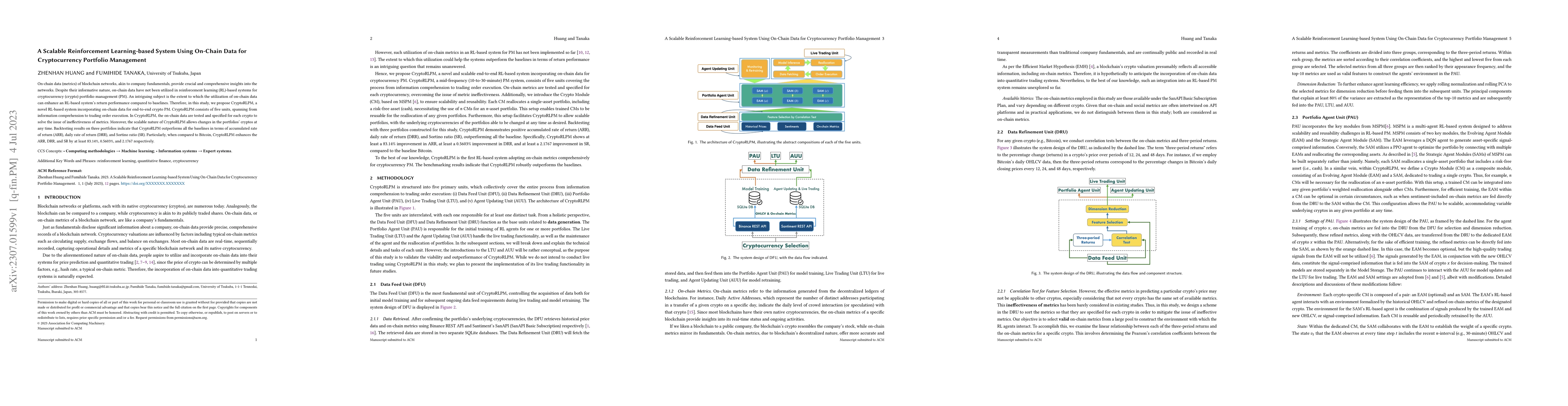

On-chain data (metrics) of blockchain networks, akin to company fundamentals, provide crucial and comprehensive insights into the networks. Despite their informative nature, on-chain data have not been utilized in reinforcement learning (RL)-based systems for cryptocurrency (crypto) portfolio management (PM). An intriguing subject is the extent to which the utilization of on-chain data can enhance an RL-based system's return performance compared to baselines. Therefore, in this study, we propose CryptoRLPM, a novel RL-based system incorporating on-chain data for end-to-end crypto PM. CryptoRLPM consists of five units, spanning from information comprehension to trading order execution. In CryptoRLPM, the on-chain data are tested and specified for each crypto to solve the issue of ineffectiveness of metrics. Moreover, the scalable nature of CryptoRLPM allows changes in the portfolios' cryptos at any time. Backtesting results on three portfolios indicate that CryptoRLPM outperforms all the baselines in terms of accumulated rate of return (ARR), daily rate of return (DRR), and Sortino ratio (SR). Particularly, when compared to Bitcoin, CryptoRLPM enhances the ARR, DRR, and SR by at least 83.14%, 0.5603%, and 2.1767 respectively.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)