Authors

Summary

We develop an efficient pricing approach for guaranteed minimum withdrawal benefits (GMWBs) with continuous withdrawals under a realistic modeling setting with jump-diffusions and stochastic interest rate. Utilizing an impulse stochastic control framework, we formulate the no-arbitrage GMWB pricing problem as a time-dependent Hamilton-Jacobi-Bellman (HJB) Quasi-Variational Inequality (QVI) having three spatial dimensions with cross derivative terms. Through a novel numerical approach built upon a combination of a semi-Lagrangian method and the Green's function of an associated linear partial integro-differential equation, we develop an $\epsilon$-monotone Fourier pricing method, where $\epsilon > 0$ is a monotonicity tolerance. Together with a provable strong comparison result for the HJB-QVI, we mathematically demonstrate convergence of the proposed scheme to the viscosity solution of the HJB-QVI as $\epsilon \to 0$. We present a comprehensive study of the impact of simultaneously considering jumps in the sub-account process and stochastic interest rate on the no-arbitrage prices and fair insurance fees of GMWBs, as well as on the holder's optimal withdrawal behaviors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

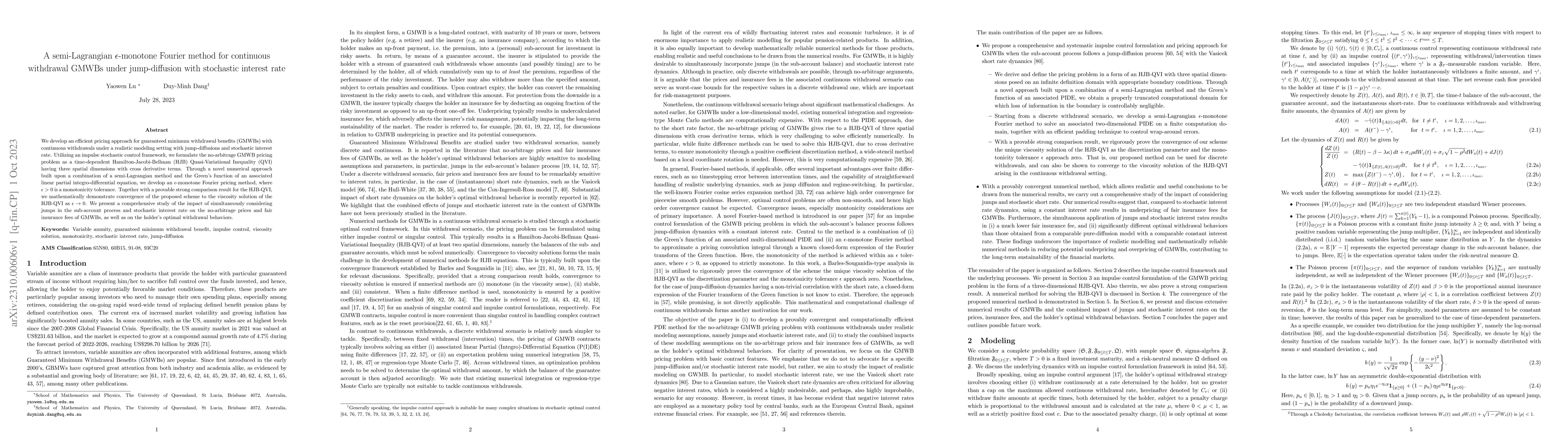

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA monotone numerical integration method for mean-variance portfolio optimization under jump-diffusion models

Duy-Minh Dang, Hanwen Zhang

| Title | Authors | Year | Actions |

|---|

Comments (0)