Summary

In recent literature it is claimed that BitCoin price behaves more likely to a volatile stock asset than a currency and that changes in its price are influenced by sentiment about the BitCoin system itself; in Kristoufek [10] the author analyses transaction based as well as popularity based potential drivers of the BitCoin price finding positive evidence. Here, we endorse this finding and consider a bivariate model in continuous time to describe the price dynamics of one BitCoin as well as a second factor, affecting the price itself, which represents a sentiment indicator. We prove that the suggested model is arbitrage-free under a mild condition and, based on risk-neutral evaluation, we obtain a closed formula to approximate the price of European style derivatives on the BitCoin. By applying the same approximation technique to the joint likelihood of a discrete sample of the bivariate process, we are also able to fit the model to market data. This is done by using both the Volume and the number of Google searches as possible proxies for the sentiment factor. Further, the performance of the pricing formula is assessed on a sample of market option prices obtained by the website deribit.com.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

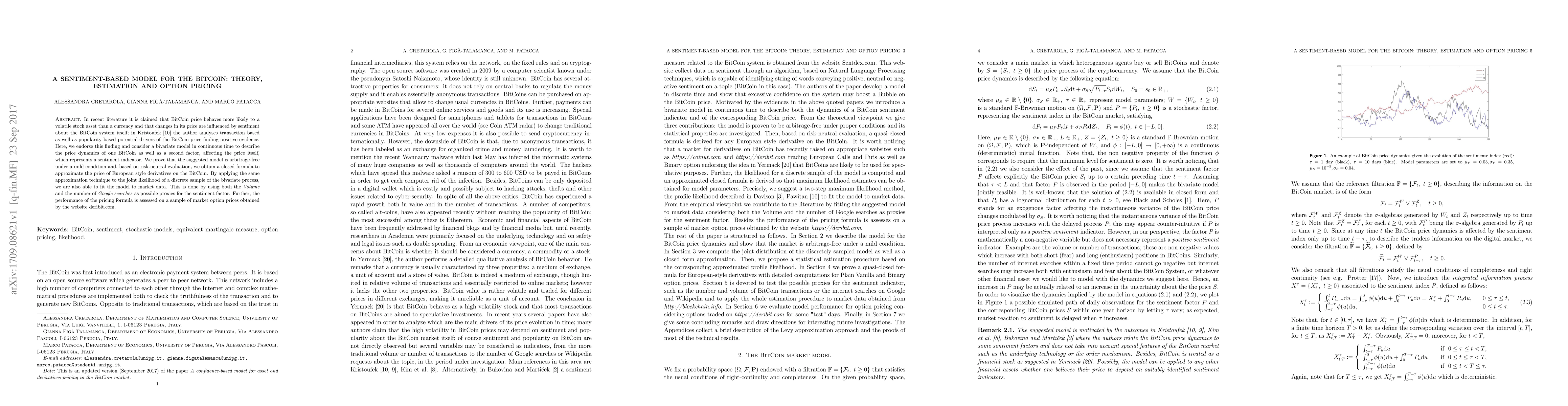

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBitcoin option pricing: A market attention approach

Alet Roux, Alvaro Guinea Julia

Neural Network for valuing Bitcoin options under jump-diffusion and market sentiment model

Edson Pindza, Jules Clement Mba, Sutene Mwambi et al.

Regime-based Implied Stochastic Volatility Model for Crypto Option Pricing

Tomaso Aste, Yuanrong Wang, Danial Saef

| Title | Authors | Year | Actions |

|---|

Comments (0)