Summary

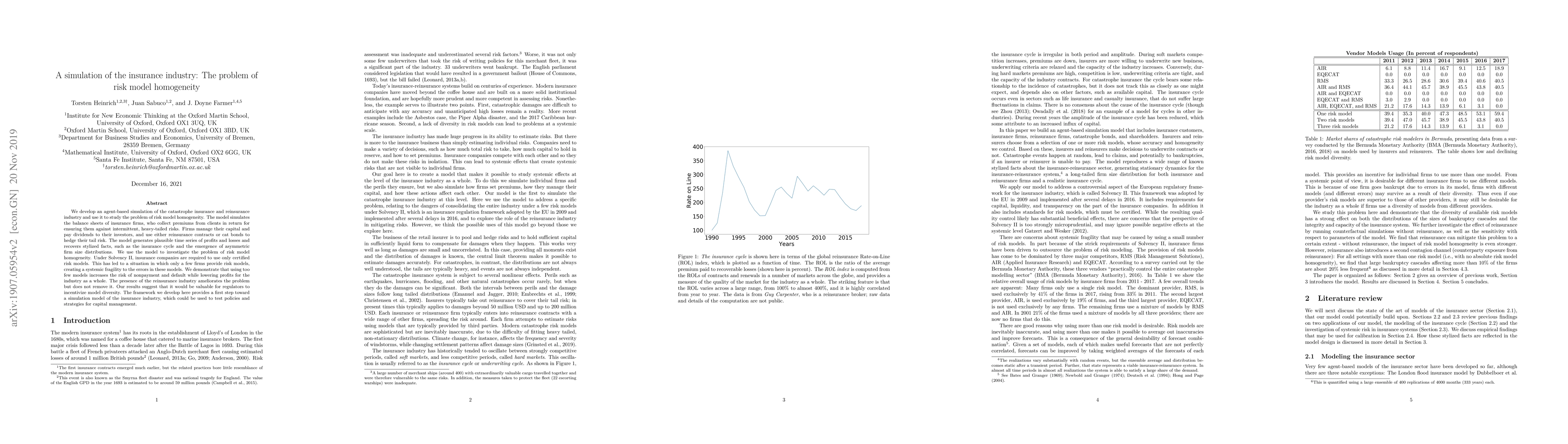

We develop an agent-based simulation of the catastrophe insurance and reinsurance industry and use it to study the problem of risk model homogeneity. The model simulates the balance sheets of insurance firms, who collect premiums from clients in return for ensuring them against intermittent, heavy-tailed risks. Firms manage their capital and pay dividends to their investors, and use either reinsurance contracts or cat bonds to hedge their tail risk. The model generates plausible time series of profits and losses and recovers stylized facts, such as the insurance cycle and the emergence of asymmetric, long tailed firm size distributions. We use the model to investigate the problem of risk model homogeneity. Under Solvency II, insurance companies are required to use only certified risk models. This has led to a situation in which only a few firms provide risk models, creating a systemic fragility to the errors in these models. We demonstrate that using too few models increases the risk of nonpayment and default while lowering profits for the industry as a whole. The presence of the reinsurance industry ameliorates the problem but does not remove it. Our results suggest that it would be valuable for regulators to incentivize model diversity. The framework we develop here provides a first step toward a simulation model of the insurance industry for testing policies and strategies for better capital management.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModel Transparency and Interpretability : Survey and Application to the Insurance Industry

Franck Vermet, Antoine Ly, Dimitri Delcaillau et al.

On the Role of Risk Perceptions in Cyber Insurance Contracts

Quanyan Zhu, Shutian Liu

| Title | Authors | Year | Actions |

|---|

Comments (0)