Summary

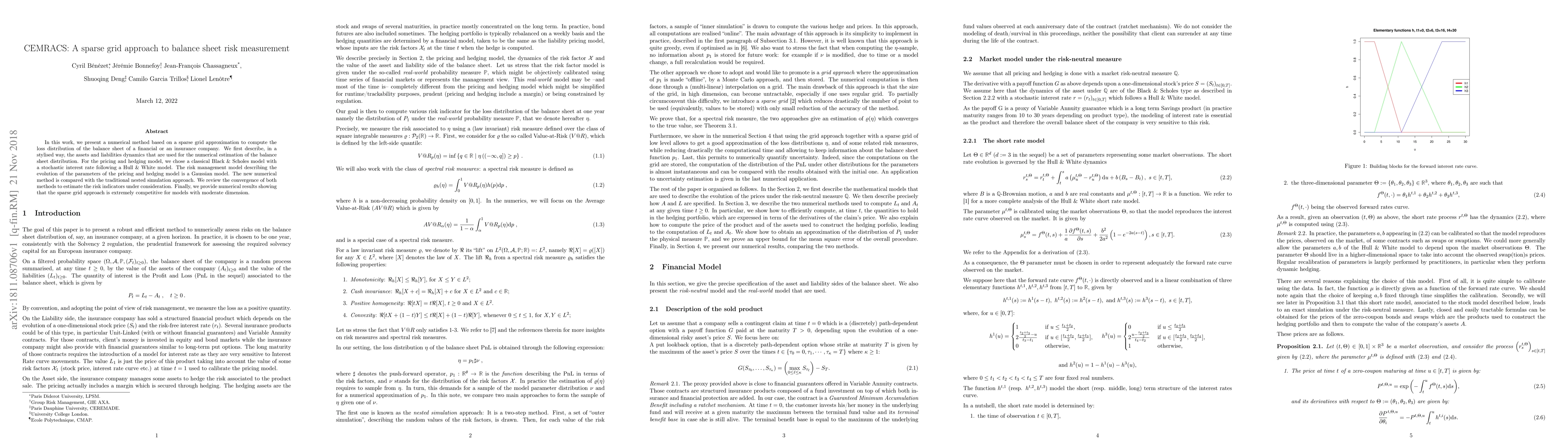

In this work, we present a numerical method based on a sparse grid approximation to compute the loss distribution of the balance sheet of a financial or an insurance company. We first describe, in a stylised way, the assets and liabilities dynamics that are used for the numerical estimation of the balance sheet distribution. For the pricing and hedging model, we chose a classical Black & Scholes model with a stochastic interest rate following a Hull & White model. The risk management model describing the evolution of the parameters of the pricing and hedging model is a Gaussian model. The new numerical method is compared with the traditional nested simulation approach. We review the convergence of both methods to estimate the risk indicators under consideration. Finally, we provide numerical results showing that the sparse grid approach is extremely competitive for models with moderate dimension.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Deep Learning Approach for Dynamic Balance Sheet Stress Testing

Sotirios Chatzis, Anastasios Petropoulos, Konstantinos P. Panousis et al.

A Scalable Approach to Large Scale Risk-Averse Distribution Grid Expansion Planning

Alexandre Moreira, Miguel Heleno, Alan Valenzuela et al.

No citations found for this paper.

Comments (0)