Summary

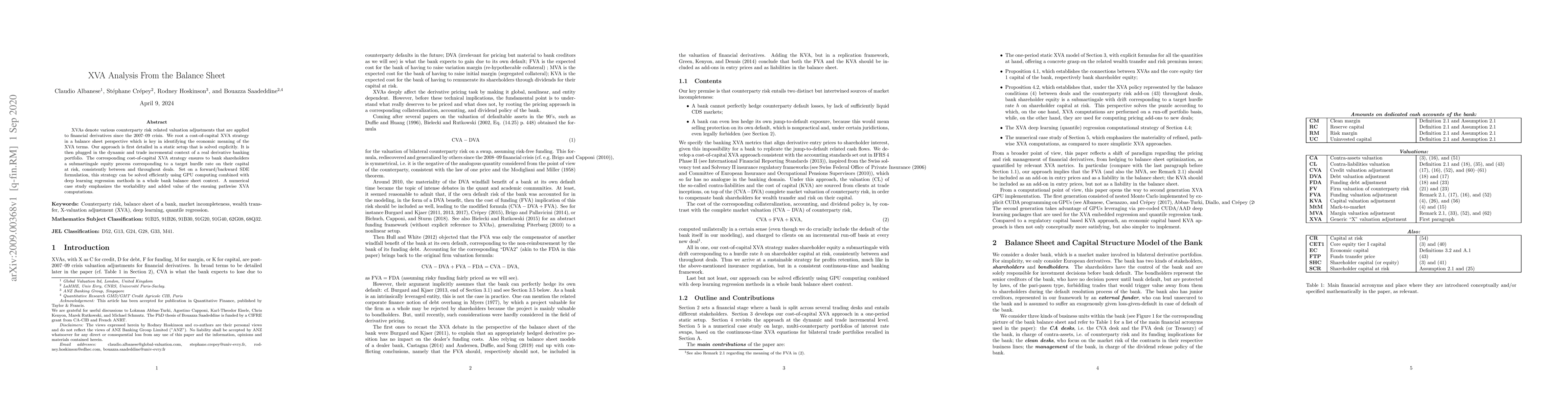

XVAs denote various counterparty risk related valuation adjustments that are applied to financial derivatives since the 2007--09 crisis. We root a cost-of-capital XVA strategy in a balance sheet perspective which is key in identifying the economic meaning of the XVA terms. Our approach is first detailed in a static setup that is solved explicitly. It is then plugged in the dynamic and trade incremental context of a real derivative banking portfolio. The corresponding cost-of-capital XVA strategy ensures to bank shareholders a submartingale equity process corresponding to a target hurdle rate on their capital at risk, consistently between and throughout deals. Set on a forward/backward SDE formulation, this strategy can be solved efficiently using GPU computing combined with deep learning regression methods in a whole bank balance sheet context. A numerical case study emphasizes the workability and added value of the ensuing pathwise XVA computations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)