Summary

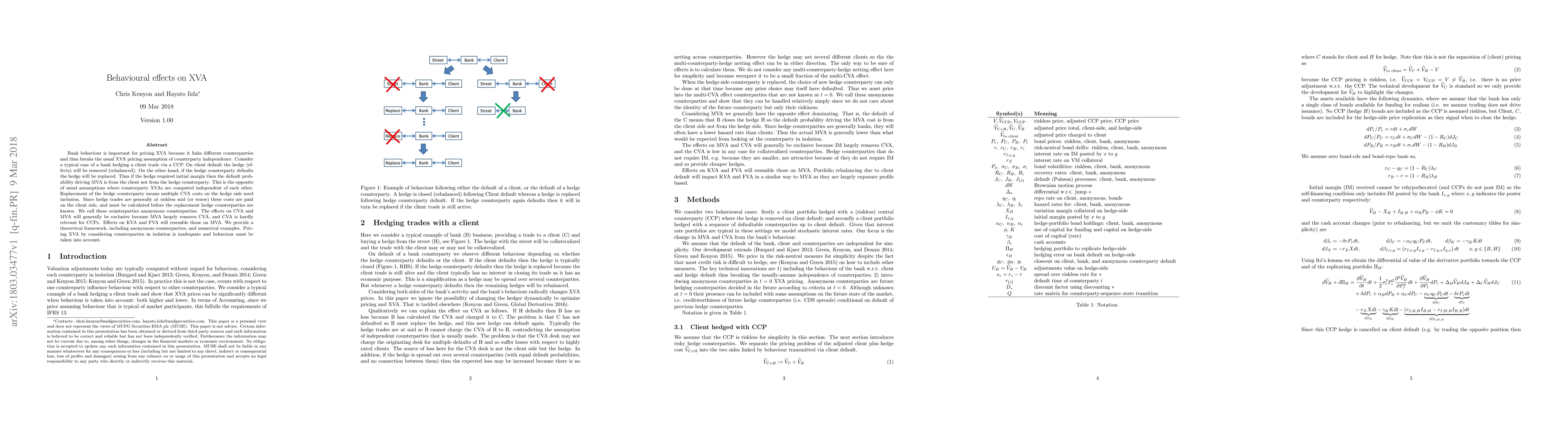

Bank behaviour is important for pricing XVA because it links different counterparties and thus breaks the usual XVA pricing assumption of counterparty independence. Consider a typical case of a bank hedging a client trade via a CCP. On client default the hedge (effects) will be removed (rebalanced). On the other hand, if the hedge counterparty defaults the hedge will be replaced. Thus if the hedge required initial margin then the default probability driving MVA is from the client not from the hedge counterparty. This is the opposite of usual assumptions where counterparty XVAs are computed independent of each other. Replacement of the hedge counterparty means multiple CVA costs on the hedge side need inclusion. Since hedge trades are generally at riskless mid (or worse) these costs are paid on the client side, and must be calculated before the replacement hedge counterparties are known. We call these counterparties anonymous counterparties. The effects on CVA and MVA will generally be exclusive because MVA largely removes CVA, and CVA is hardly relevant for CCPs. Effects on KVA and FVA will resemble those on MVA. We provide a theoretical framework, including anonymous counterparties, and numerical examples. Pricing XVA by considering counterparties in isolation is inadequate and behaviour must be taken into account.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)