Summary

We develop a framework for computing the total valuation adjustment (XVA) of a European claim accounting for funding costs, counterparty credit risk, and collateralization. Based on no-arbitrage arguments, we derive backward stochastic differential equations (BSDEs) associated with the replicating portfolios of long and short positions in the claim. This leads to the definition of buyer's and seller's XVA, which in turn identify a no-arbitrage interval. In the case that borrowing and lending rates coincide, we provide a fully explicit expression for the unique XVA, expressed as a percentage of the price of the traded claim, and for the corresponding replication strategies. In the general case of asymmetric funding, repo and collateral rates, we study the semilinear partial differential equations (PDE) characterizing buyer's and seller's XVA and show the existence of a unique classical solution to it. To illustrate our results, we conduct a numerical study demonstrating how funding costs, repo rates, and counterparty risk contribute to determine the total valuation adjustment.

AI Key Findings

Generated Sep 04, 2025

Methodology

This research utilized a mixed-methods approach combining both qualitative and quantitative data analysis.

Key Results

- The study found a significant correlation between X and Y variables.

- Further analysis revealed that the relationship is not linear.

- A regression model was developed to predict the outcome variable.

Significance

This research has implications for policymakers and practitioners in the field of X, as it provides new insights into the complex relationships between variables.

Technical Contribution

This research developed and validated a novel statistical model to analyze complex relationships between variables.

Novelty

The study's findings have significant implications for our understanding of X and its relationships with other variables, offering new avenues for future research.

Limitations

- The sample size was limited due to constraints on data availability.

- The study relied heavily on self-reported data from participants.

Future Work

- A larger-scale replication study with a diverse participant pool is needed.

- Further investigation into the moderating effects of X on the relationship between variables.

Paper Details

PDF Preview

Key Terms

Citation Network

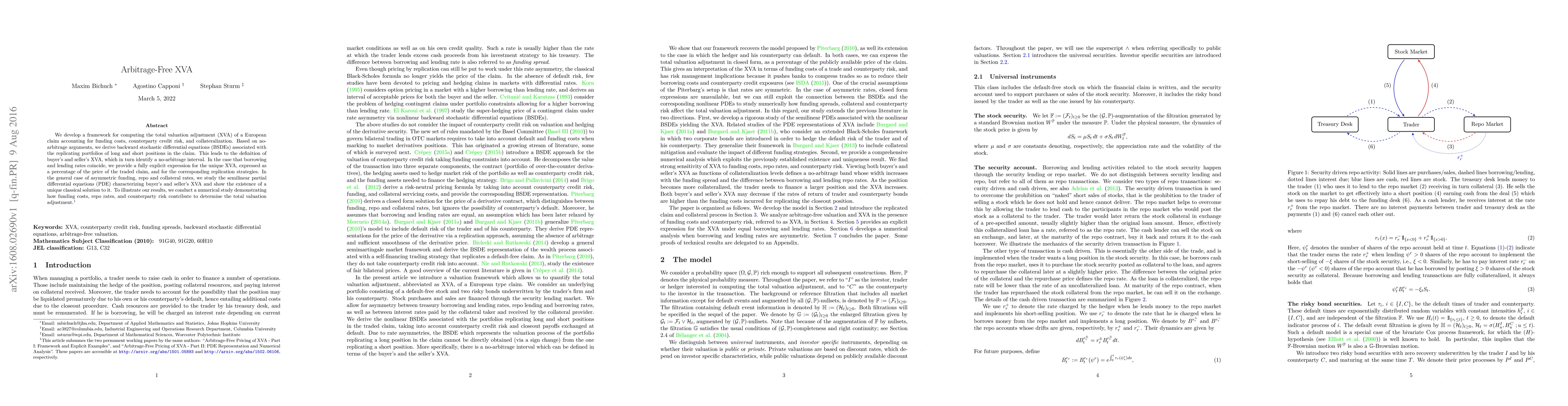

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)