Summary

In this article we propose a generalisation of the recent work of Gatheral and Jacquier on explicit arbitrage-free parameterisations of implied volatility surfaces. We also discuss extensively the notion of arbitrage freeness and Roger Lee's moment formula using the recent analysis by Roper. We further exhibit an arbitrage-free volatility surface different from Gatheral's SVI parameterisation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

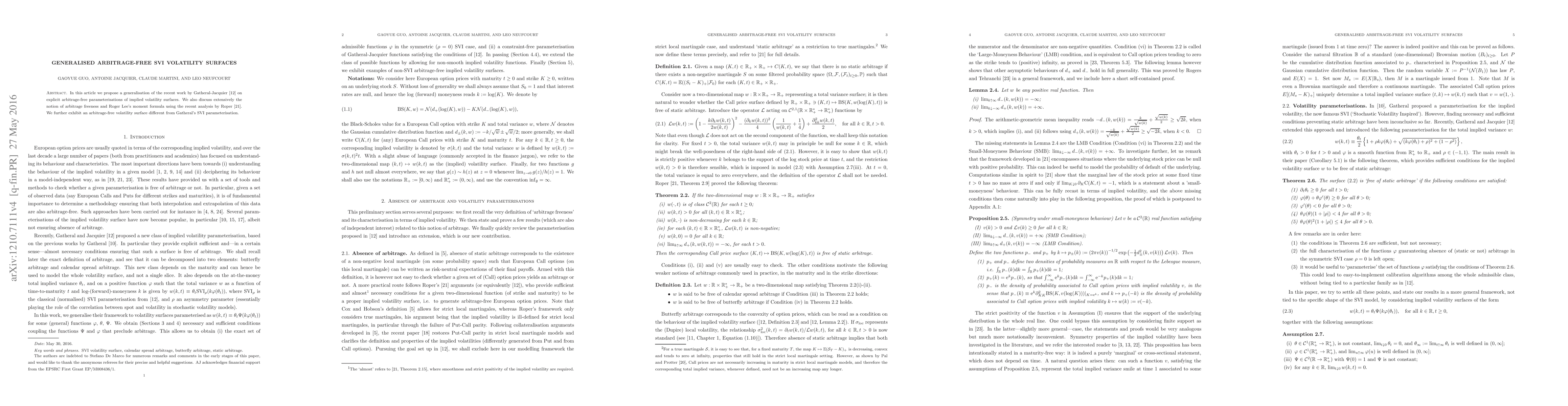

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersArbitrage-Free Implied Volatility Surface Generation with Variational Autoencoders

Sebastian Jaimungal, Maxime Bergeron, Xiaorong Zhang et al.

Computing Volatility Surfaces using Generative Adversarial Networks with Minimal Arbitrage Violations

Andrew Na, Justin Wan, Meixin Zhang

| Title | Authors | Year | Actions |

|---|

Comments (0)