Summary

We study the semilinear partial differential equation (PDE) associated with the non-linear BSDE characterizing buyer's and seller's XVA in a framework that allows for asymmetries in funding, repo and collateral rates, as well as for early contract termination due to counterparty credit risk. We show the existence of a unique classical solution to the PDE by first proving the existence and uniqueness of a viscosity solution and then its regularity. We use the uniqueness result to conduct a thorough numerical study illustrating how funding costs, repo rates, and counterparty credit risk contribute to determine the total valuation adjustment.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

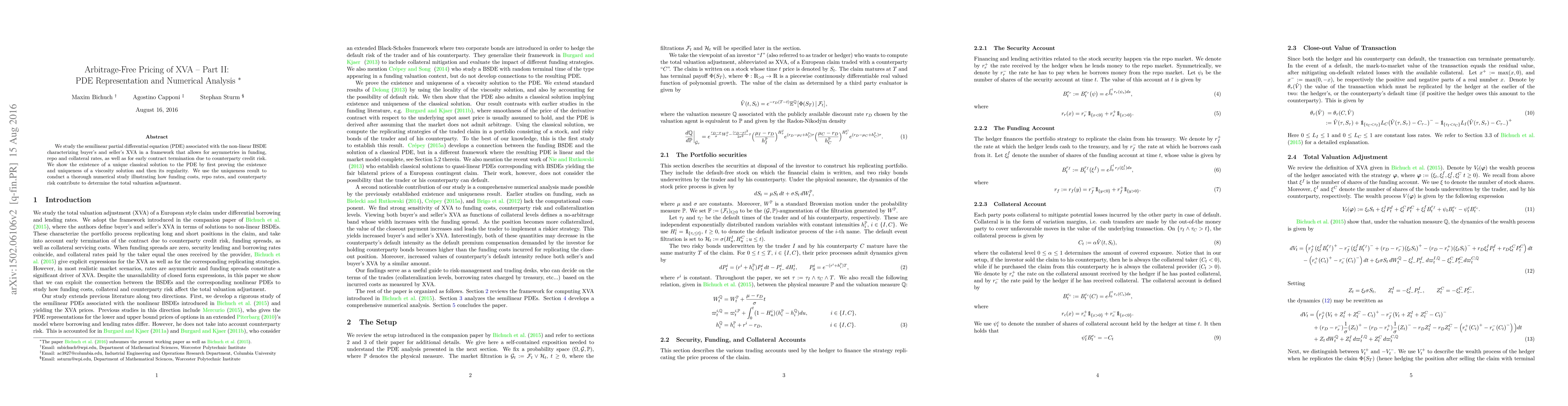

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe fundamental representation of pricing adjustments

Benedict Burnett, Ryan McCrickerd, Benjamin Piau

| Title | Authors | Year | Actions |

|---|

Comments (0)