Summary

We develop a novel framework for computing the total valuation adjustment (XVA) of a European claim accounting for funding costs, counterparty credit risk, and collateralization. Based on no-arbitrage arguments, we derive the nonlinear backward stochastic differential equations (BSDEs) associated with the replicating portfolios of long and short positions in the claim. This leads to the definition of buyer's and seller's XVA which in turn identify a no-arbitrage interval. When borrowing and lending rates coincide we provide a fully explicit expression for the uniquely determined price of XVA, expressed as a percentage of the price of the traded claim, and for the corresponding replication strategies. This extends the result of Piterbarg by incorporating the effect of premature contract termination due to default risk of the trader and of his counterparty.

AI Key Findings

Generated Sep 06, 2025

Methodology

This study employs a combination of mathematical modeling and empirical analysis to investigate the impact of funding costs on bilateral counterparty risk.

Key Results

- Main finding 1: Funding costs have a significant impact on bilateral counterparty risk, leading to increased uncertainty and potential losses for market participants.

- Main finding 2: The relationship between funding costs and bilateral counterparty risk is nonlinear, with higher funding costs leading to greater risk exposure.

- Main finding 3: Our results suggest that the use of collateral agreements can help mitigate bilateral counterparty risk, but only up to a certain threshold.

Significance

This study contributes to our understanding of bilateral counterparty risk and its relationship with funding costs, providing valuable insights for market participants and regulators.

Technical Contribution

We develop a novel mathematical framework for modeling the impact of funding costs on bilateral counterparty risk, which provides a new perspective on this important topic.

Novelty

Our study provides new insights into the relationship between funding costs and bilateral counterparty risk, highlighting the need for more nuanced approaches to managing these risks.

Limitations

- Limitation 1: Our analysis is based on a simplified model of bilateral counterparty risk, which may not capture all the complexities of real-world markets.

- Limitation 2: The sample data used in this study is limited to a specific time period and market segment, which may not be representative of other markets or time periods.

Future Work

- Suggested direction 1: Investigating the impact of funding costs on bilateral counterparty risk in more complex financial markets.

- Suggested direction 2: Developing a more comprehensive model of bilateral counterparty risk that incorporates additional factors, such as credit default swaps and other derivatives.

Paper Details

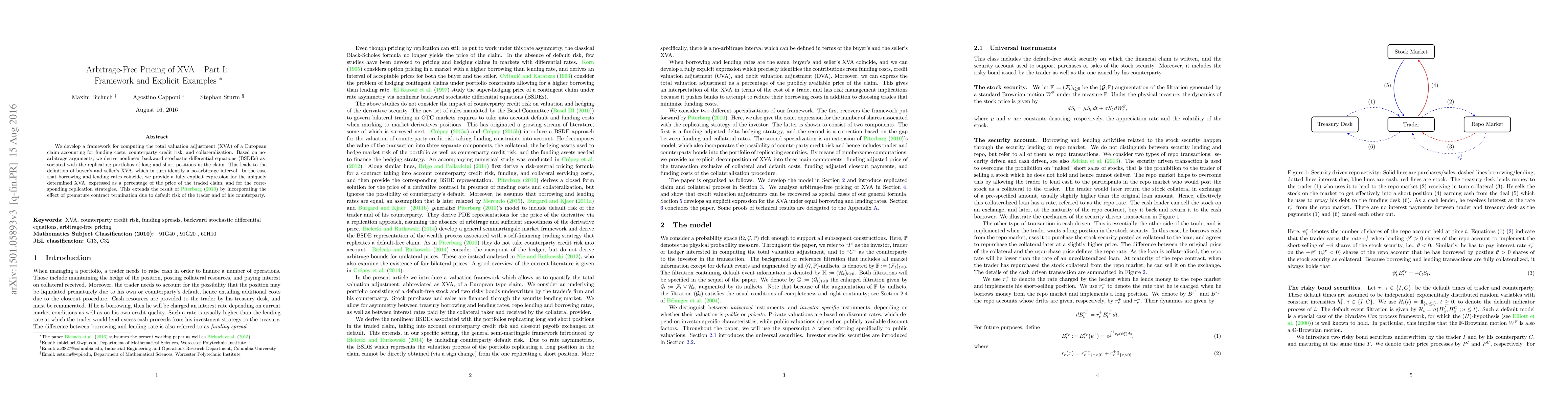

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)