Summary

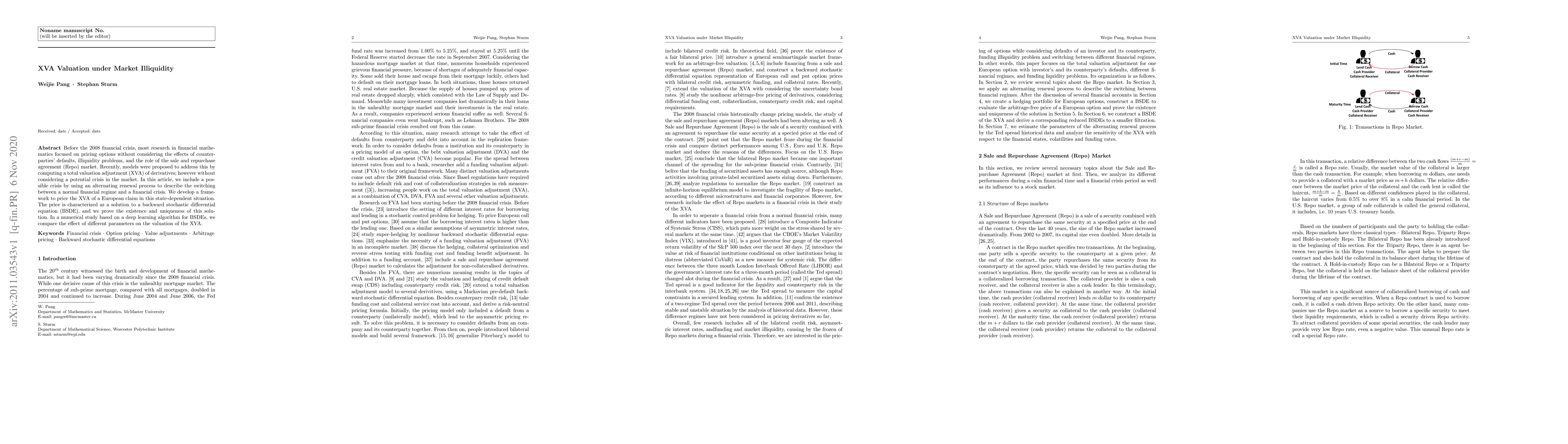

Before the 2008 financial crisis, most research in financial mathematics focused on pricing options without considering the effects of counterparties' defaults, illiquidity problems, and the role of the sale and repurchase agreement (Repo) market. Recently, models were proposed to address this by computing a total valuation adjustment (XVA) of derivatives; however without considering a potential crisis in the market. In this article, we include a possible crisis by using an alternating renewal process to describe the switching between a normal financial regime and a financial crisis. We develop a framework to price the XVA of a European claim in this state-dependent situation. The price is characterized as a solution to a backward stochastic differential equation (BSDE), and we prove the existence and uniqueness of this solution. In a numerical study based on a deep learning algorithm for BSDEs, we compare the effect of different parameters on the valuation of the XVA.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)