Summary

We provide an economically sound micro-foundation to linear price impact models, by deriving them as the equilibrium of a suitable agent-based system. Our setup generalizes the well-known Kyle model, by dropping the assumption of a terminal time at which fundamental information is revealed so to describe a stationary market, while retaining agents' rationality and asymmetric information. We investigate the stationary equilibrium for arbitrary Gaussian noise trades and fundamental information, and show that the setup is compatible with universal price diffusion at small times, and non-universal mean-reversion at time scales at which fluctuations in fundamentals decay. Our model provides a testable relation between volatility of prices, magnitude of fluctuations in fundamentals and level of volume traded in the market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

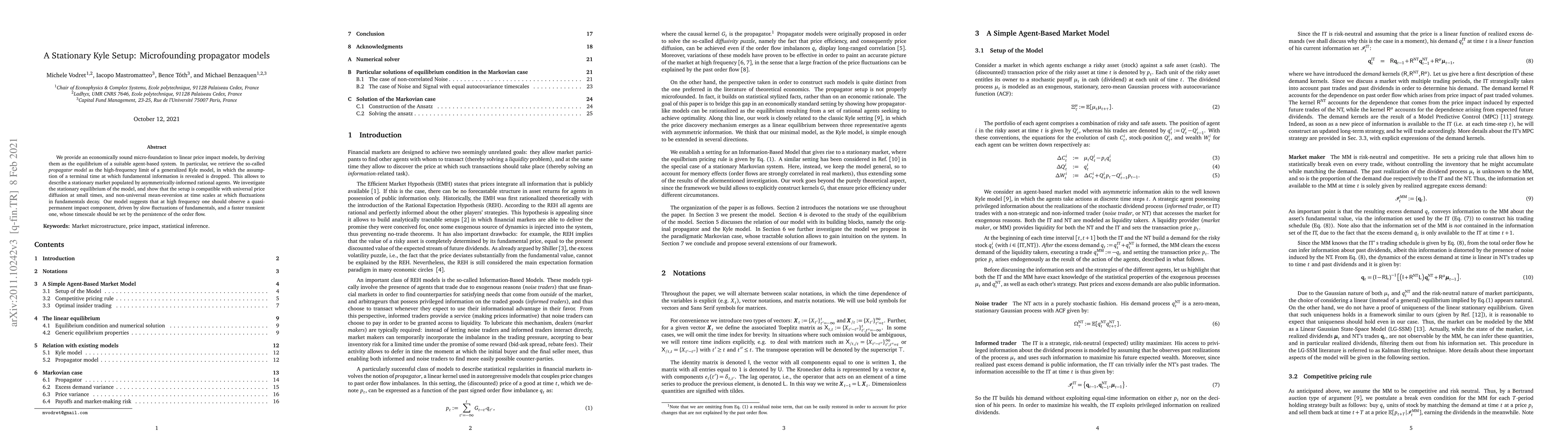

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMicrofounding GARCH Models and Beyond: A Kyle-inspired Model with Adaptive Agents

Michael Benzaquen, Iacopo Mastromatteo, Michele Vodret et al.

Trading constraints in continuous-time Kyle models

Kasper Larsen, Jin Hyuk Choi, Heeyoung Kwon

| Title | Authors | Year | Actions |

|---|

Comments (0)