Summary

We discuss a class of debt management problems in a stochastic environment model. We propose a model for the debt-to-GDP (Gross Domestic Product) ratio where the government interventions via fiscal policies affect the public debt and the GDP growth rate at the same time. We allow for stochastic interest rate and possible correlation with the GDP growth rate through the dependence of both the processes (interest rate and GDP growth rate) on a stochastic factor which may represent any relevant macroeconomic variable, such as the state of economy. We tackle the problem of a government whose goal is to determine the fiscal policy in order to minimize a general functional cost. We prove that the value function is a viscosity solution to the Hamilton-Jacobi-Bellman equation and provide a Verification Theorem based on classical solutions. We investigate the form of the candidate optimal fiscal policy in many cases of interest, providing interesting policy insights. Finally, we discuss two applications to the debt reduction problem and debt smoothing, providing explicit expressions of the value function and the optimal policy in some special cases.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

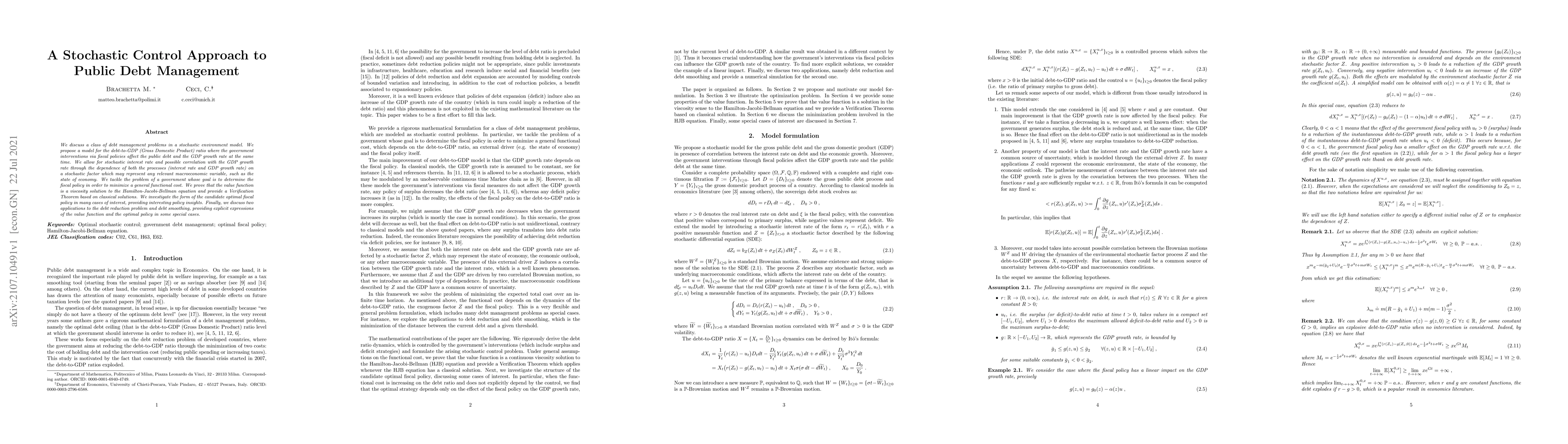

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)