Summary

The aim of the present article is to treat the Greek public debt issue strictly as a curve fitting problem. Thus, based on Eurostat data and using the Mathematica technical computing software, an exponential function that best fits the data is determined modelling how the Greek public debt expands with time. Exploring the main features of this best fit model, it is concluded that the Greek public debt cannot possibly be serviced in the long run unless a radical growth is implemented and/or part of the debt is written off.

AI Key Findings

Generated Sep 02, 2025

Methodology

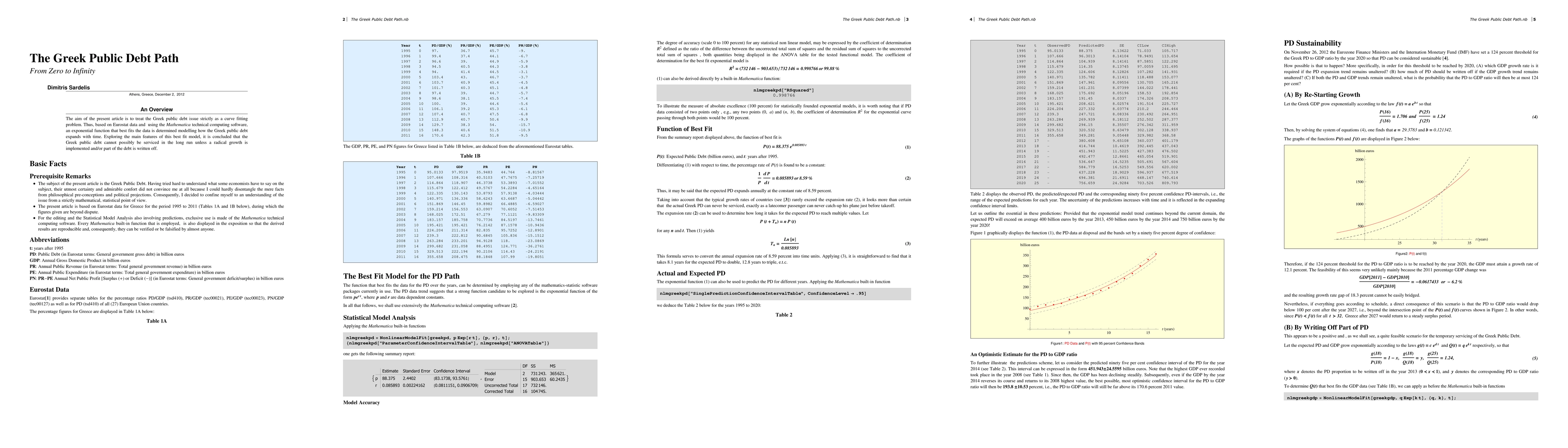

The research treats the Greek public debt as a curve fitting problem using Eurostat data and Mathematica software to determine an exponential function that best fits the debt expansion over time.

Key Results

- An exponential function (PHtL = 88.375 * 0.085893^t) was derived to model the Greek public debt, showing an annual expansion rate of 8.59%.

- The expected public debt is predicted to exceed 400 billion euros by 2013, 450 billion euros by 2014, and 750 billion euros by 2020, assuming the exponential trend continues.

- To reach a sustainable 124% PD to GDP ratio by 2020, GDP growth would need to be 12.1%, which is considered unlikely given past trends.

- Writing off part of the public debt while maintaining GDP growth trends is a feasible scenario to temporarily service the debt and reach the 124% threshold by 2020.

- If both PD and GDP trends remain unaltered, the probability of the PD to GDP ratio being at most 124% in 2020 is very low (0.00971359).

Significance

This research provides a mathematical and statistical analysis of the Greek public debt, offering insights into its future trajectory and potential sustainability issues, which can inform policy decisions and debt management strategies.

Technical Contribution

The application of curve fitting techniques and statistical modeling using Mathematica software to analyze and predict the Greek public debt trajectory.

Novelty

This research offers a unique mathematical perspective on the Greek public debt issue, providing detailed predictions and assessing the feasibility of different scenarios for debt sustainability.

Limitations

- The study relies on historical data and assumes that the exponential trend will continue, which may not hold in the face of unforeseen economic changes or policy interventions.

- The analysis does not account for potential political, social, or external economic factors that could influence the Greek public debt dynamics.

Future Work

- Investigating non-exponential models to better capture potential changes in debt dynamics over time.

- Exploring the impact of various policy interventions on the Greek public debt and its sustainability.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersCharacterizing Public Debt Cycles: Don't Ignore the Impact of Financial Cycles

Yingying Xu, Tianbao Zhou, Zhixin Liu

No citations found for this paper.

Comments (0)