Summary

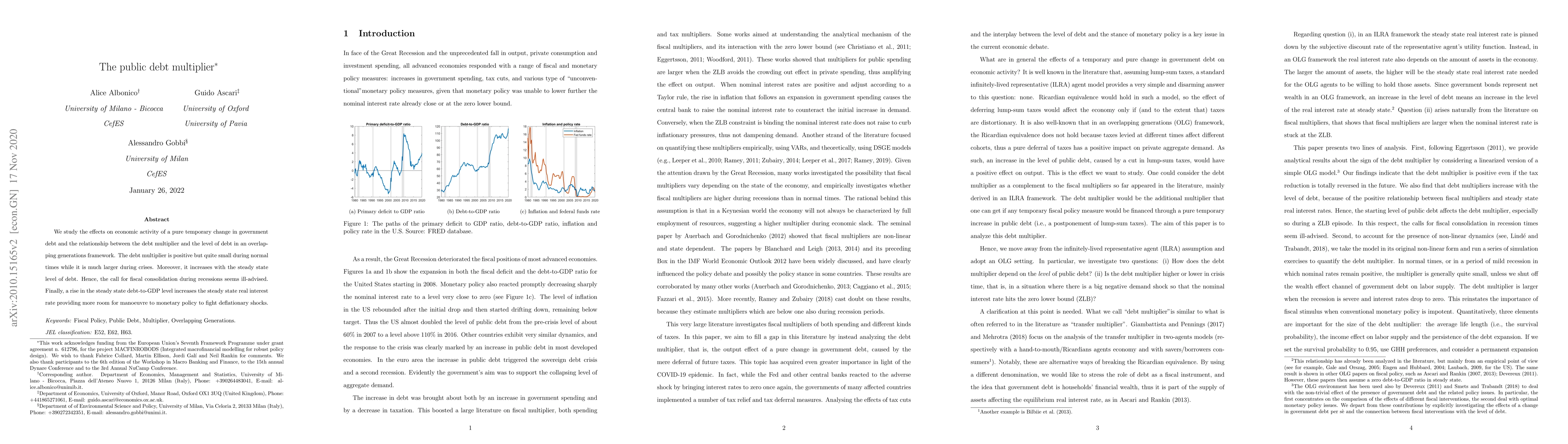

We study the effects on economic activity of a pure temporary change in government debt and the relationship between the debt multiplier and the level of debt in an overlapping generations framework. The debt multiplier is positive but quite small during normal times while it is much larger during crises. Moreover, it increases with the steady state level of debt. Hence, the call for fiscal consolidation during recessions seems ill-advised. Finally, a rise in the steady state debt-to-GDP level increases the steady state real interest rate providing more room for manoeuvre to monetary policy to fight deflationary shocks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCharacterizing Public Debt Cycles: Don't Ignore the Impact of Financial Cycles

Yingying Xu, Tianbao Zhou, Zhixin Liu

| Title | Authors | Year | Actions |

|---|

Comments (0)