Summary

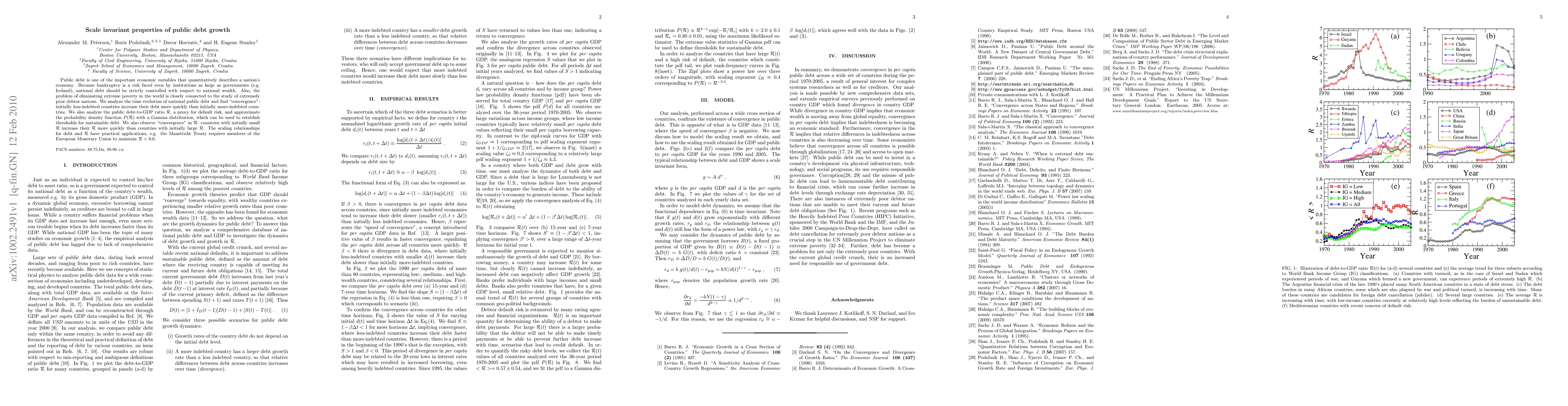

Public debt is one of the important economic variables that quantitatively describes a nation's economy. Because bankruptcy is a risk faced even by institutions as large as governments (e.g. Iceland), national debt should be strictly controlled with respect to national wealth. Also, the problem of eliminating extreme poverty in the world is closely connected to the study of extremely poor debtor nations. We analyze the time evolution of national public debt and find "convergence": initially less-indebted countries increase their debt more quickly than initially more-indebted countries. We also analyze the public debt-to-GDP ratio R, a proxy for default risk, and approximate the probability density function P(R) with a Gamma distribution, which can be used to establish thresholds for sustainable debt. We also observe "convergence" in R: countries with initially small R increase their R more quickly than countries with initially large R. The scaling relationships for debt and R have practical applications, e.g. the Maastricht Treaty requires members of the European Monetary Union to maintain R < 0.6.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRethinking Indonesia's Public Debt in the Era of Negative Interest Rate-Growth Differentials

Mervin Goklas Hamonangan

How do financial variables impact public debt growth in China? An empirical study based on Markov regime-switching model

Yingying Xu, Tianbao Zhou, Zhixin Liu

Characterizing Public Debt Cycles: Don't Ignore the Impact of Financial Cycles

Yingying Xu, Tianbao Zhou, Zhixin Liu

| Title | Authors | Year | Actions |

|---|

Comments (0)