Summary

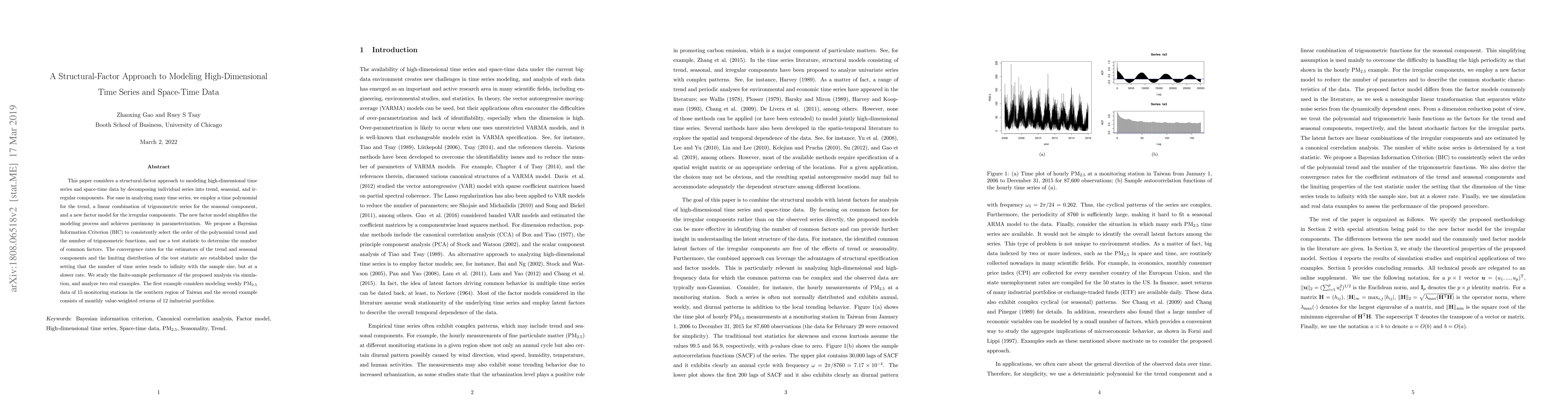

This paper considers a structural-factor approach to modeling high-dimensional time series and space-time data by decomposing individual series into trend, seasonal, and irregular components. For ease in analyzing many time series, we employ a time polynomial for the trend, a linear combination of trigonometric series for the seasonal component, and a new factor model for the irregular components. The new factor model can simplify the modeling process and achieve parsimony in parameterization. We propose a Bayesian Information Criterion (BIC) to consistently determine the order of the polynomial trend and the number of trigonometric functions. A test statistic is used to determine the number of common factors. The convergence rates for the estimators of the trend and seasonal components and the limiting distribution of the test statistic are established under the setting that the number of time series tends to infinity with the sample size, but at a slower rate. We use simulation to study the performance of the proposed analysis in finite samples and apply the proposed approach to two real examples. The first example considers modeling weekly PM$_{2.5}$ data of 15 monitoring stations in the southern region of Taiwan and the second example consists of monthly value-weighted returns of 12 industrial portfolios.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 paperscs-net: structural approach to time-series forecasting for high-dimensional feature space data with limited observations

Mingqian Feng, Peter Chin, Weiyu Zong et al.

Divide-and-Conquer: A Distributed Hierarchical Factor Approach to Modeling Large-Scale Time Series Data

Zhaoxing Gao, Ruey S. Tsay

| Title | Authors | Year | Actions |

|---|

Comments (0)